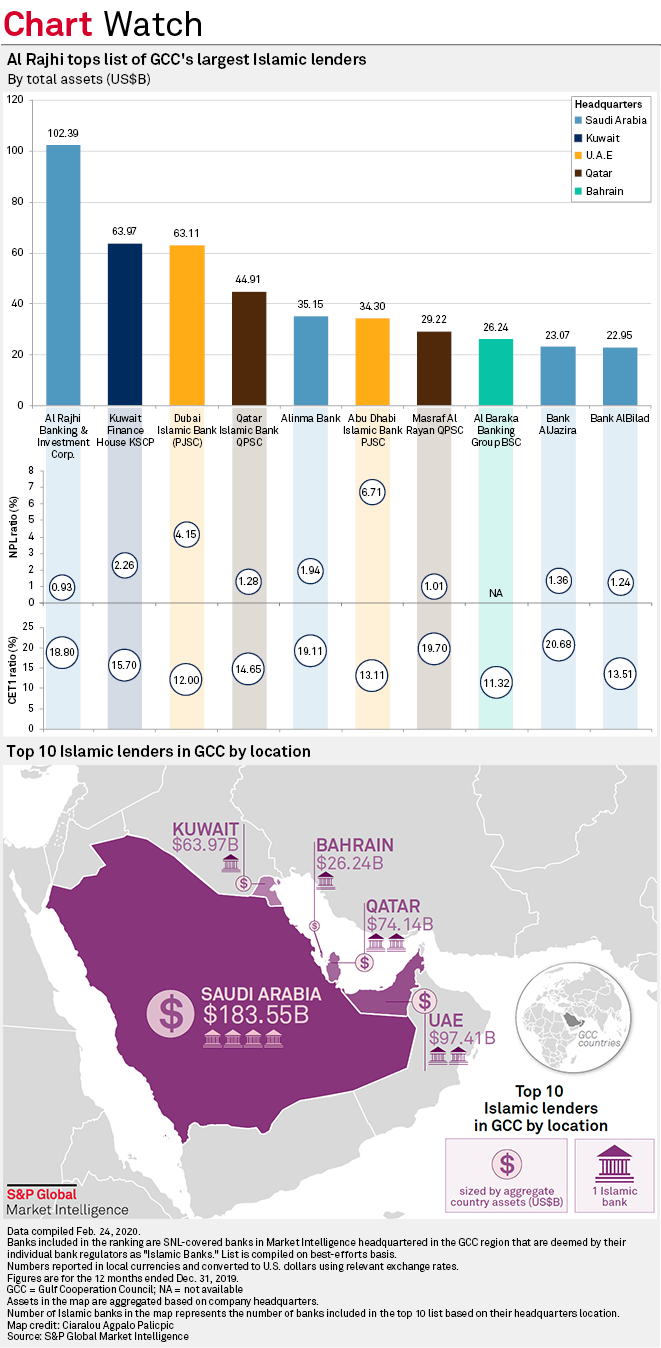

Saudi Arabia's Al Rajhi Banking & Investment Corp. holds top spot in S&P Global Market Intelligence's ranking of the largest Islamic banks in the Gulf Cooperation Council.

The GCC includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates, and accounts for 42.3% of total global Islamic assets, according to the Saudi Arabia Monetary Authority's 2019 annual report.

Saudi Arabia alone holds one-fifth of total Islamic assets worldwide, which is reflected in it having four banks in the top 10, including Al Rajhi, with total assets of $102.39 billion as of Dec. 31, 2019. Saudi peer Alinma Bank is fifth and recorded total assets of $35.15 billion.

In the UAE, Islamic deposits made up 22.0% of total sector deposits in the 2019 third quarter, according to the central bank's most recent data, versus the year-before period's 23.2%. The highest-ranked UAE bank is Dubai Islamic Bank (PJSC), in third place with total assets of $63.11 billion, according to S&P Global Market Intelligence data. It is one of two Emirati lenders in the ranking.

Kuwait Finance House KSCP is second in the ranking, with total assets of $63.97 billion, while fourth-placed Qatar Islamic Bank QPSC has assets of $44.91 billion.

Islamic banks adhere to the principles of Shariah law, under which interest is deemed harmful and is forbidden, while speculation in transactions is minimized.