Earnings for hotel real estate investment trusts nosedived in the second quarter as revenue-per-available room and occupancy metrics fell to record lows amid the coronavirus pandemic.

Industry executives said it was the worst quarter for hotels in history, adding that they hoped it would be the worst of the year. Equity investors appeared to be betting the quarter would be the low point, as shares rallied in August.

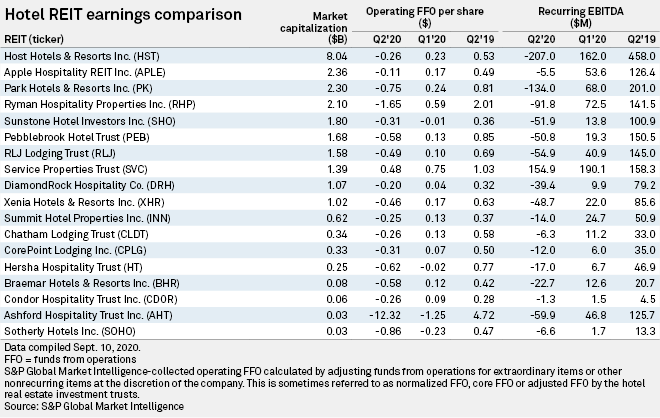

An S&P Global Market Intelligence analysis of hotel REIT earnings showed a sharp decline in operating funds from operations per share, with all but one of the hotel REITs reporting negative earnings for the quarter. For the purpose of the analysis, operating FFO was defined as FFO adjusted for extraordinary items or other nonrecurring items at the discretion of the company. Companies sometimes refer to the metric as normalized FFO or adjusted FFO.

Recurring EBITDA as calculated by S&P Global Market Intelligence followed a similar trend, with most hotel REITs deep in the red.

The quarter "was clearly the most challenging in the history of the hotel business," Pebblebrook Hotel Trust CFO Raymond Martz said in a July 31 earnings conference call.

"These are unprecedented times," Chairman and CEO Jon Bortz added. "Travel demand has never before been effectively eliminated at the same time, all around the world."

Host Hotels & Resorts Inc., the largest hotel REIT by market capitalization, reported FFO of negative 26 cents per share, compared to 23 cents per share in the first quarter of 2020 and 53 cents per share for the second quarter of 2019. Nearly all hotel REITs reported similar results, including Apple Hospitality REIT Inc., which posted modified FFO of negative 11 cents per share, and Park Hotels & Resorts Inc. and Ryman Hospitality Properties Inc., which reported adjusted FFO of negative 75 cents and negative $1.65 per share, respectively.

Service Properties Trust was the only hotel REIT to post positive FFO in the quarter, supported by its portfolio of net lease service-oriented retail properties. While its hotel operating revenue fell to roughly $117.4 million during the second quarter from $541.2 million a year earlier, its rental income for its net lease portfolio grew 51.4% year over year to $95.5 million.

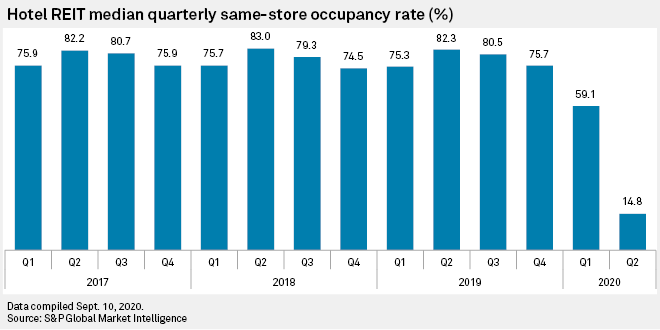

The drop in earnings coincided with record-low RevPAR and occupancy rates. Same-store RevPAR for the hotel REITs fell 88% year over year on a median basis in the second quarter, while same-store occupancy fell to 59.1% on a median basis in the first quarter, then to a low of 14.8% in the second quarter.

During earnings calls, executives at Pebblebrook and RLJ Lodging Trust said April marked the low point of traveler demand during the pandemic, with improvements driven by leisure travelers in May and June.

More recent data reported by STR shows conditions improved in the third quarter, with hotel performance declines slimmer, on a year-over-year basis, than earlier in the crisis. For the week ended Aug. 29, STR reported hotel occupancy of 48.2%, while RevPAR was down 44.5% year over year to $47.38. Meanwhile, the average daily rate fell 23.2% year over year to $98.39.

"We continue to believe that any form of recovery will likely be slow to build," RLJ President and CEO Leslie Hale said, predicting that business travel will be "very limited and anemic" for the remainder of 2020, while leisure travel will taper off with the end of summer.

DiamondRock Hospitality Company President and CEO Mark Brugger said in an Aug. 7 call that uncertainty around travel is likely to persist until there is an effective coronavirus vaccine, improved patient outcomes, or broad acceptance of safety protocols.

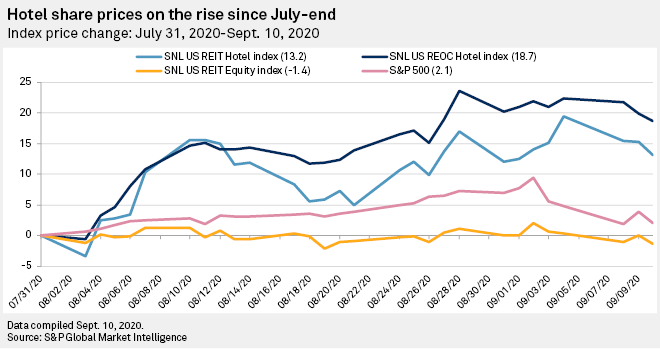

Investors may believe the worst is over: The SNL U.S. REIT Hotel index is up 13.2% since July-end, while the SNL U.S. REOC Hotel index rose 18.7%, compared to a 2.1% increase for the S&P 500 during the same time period and a 1.4% drop for the SNL U.S. REIT Equity index.