Stock market volatility jumped sharply at the end of August as investors became more uncertain about the sustainability of the rally in U.S. stocks.

The CBOE Volatility Index, or VIX — a measure of expected volatility on the S&P 500 — jumped from 22.96 to close at 26.41 on Aug. 31, the biggest single-day move since July 12 and the highest end-of-day level since July 16. The VIX was still trading above 26 in morning trading Sept. 2.

The rise in uncertainty came at the end of a strong August for U.S. equities, in which the S&P 500 recorded a series of all-time highs and ended with a monthly gain of 7.1%.

|

"Investors seem jittery about the month ahead. Worries about the Fed's ability to continue driving the economy using its current toolkit and the approaching November U.S. elections appear to be the culprits," Chris Bennett, director of index investment strategy at S&P Dow Jones Indices, wrote in a market commentary.

Another analyst warned of "irrational exuberance," considering the state of the economy, and noted a growing sense that "a big correction" could be coming.

"As a result of heightened options transactions, the volatility index has started to creep up again. This is a potentially bearish sign for stock markets and needs to be monitored closely in the upcoming week(s)," Fawad Razaqzada, an analyst at ThinkMarkets, wrote in a research note.

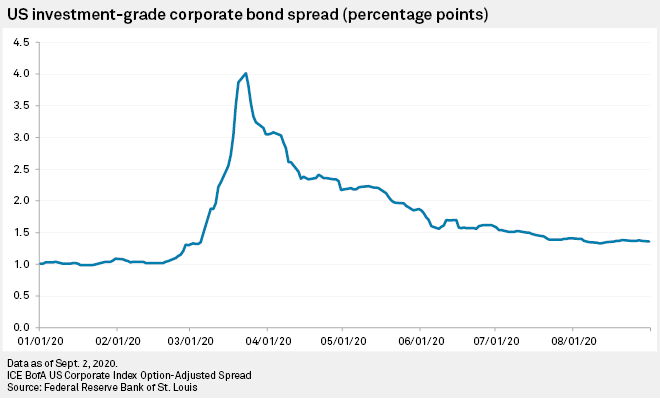

By contrast, corporate bond markets were little changed.

The U.S. investment-grade corporate spread fell 1 basis point between Aug. 24 and Aug. 31, to 136 bps. The spread was range-bound between 133 bps and 140 bps throughout August after averaging 146 bps in July.

The spread has reversed 88.6% of the widening it experienced between March 5 and March 23 as the coronavirus pandemic upended markets.

|

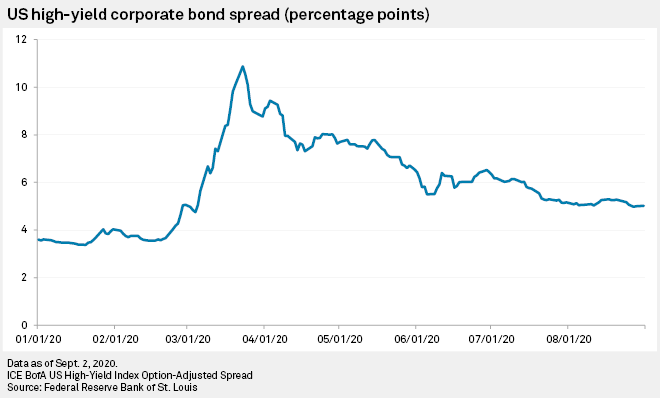

The U.S. high-yield corporate bond market was also quiet, having closed below 500 bps Aug. 27 for the first time since March 4. The spread was back to 502 bps on Aug. 31, still down 5 bps in a week.

The spread averaged 512 bps in August and has reversed 80.1% of its pandemic blowout.

|

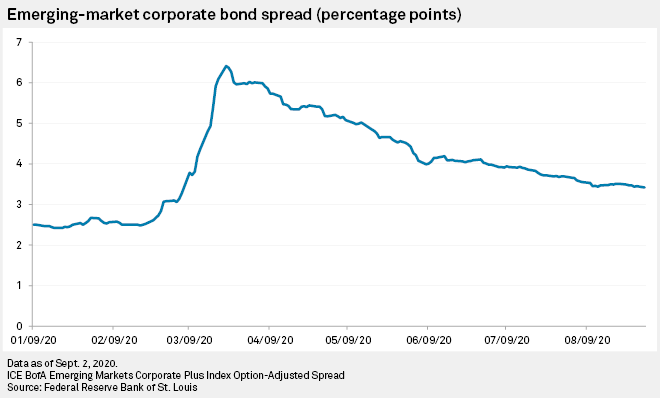

Emerging-market corporate bond spreads continued to grind lower, shedding 7 bps between Aug. 24 and Sept. 31, to 342 bps.

The spread is taking longer to reverse the coronavirus widening than the other bond markets, with 76.1% of the increase now unwound.

|

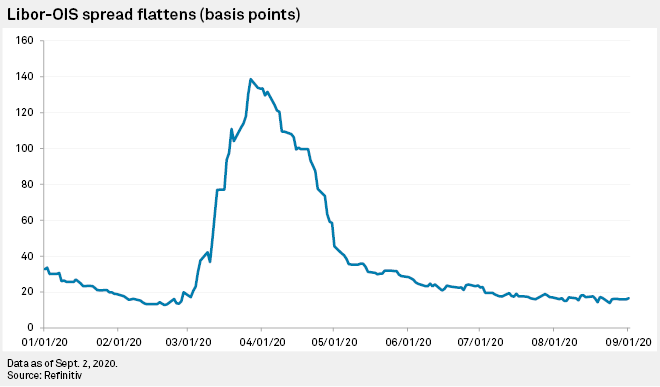

The Libor-OIS spread, a key risk indicator for the U.S. banking sector measuring the difference between the three-month dollar London interbank offered rate and the overnight indexed swap rate, was 16.6 bps as of Sep. 1, up from 15.9 bps on Aug. 25.

|

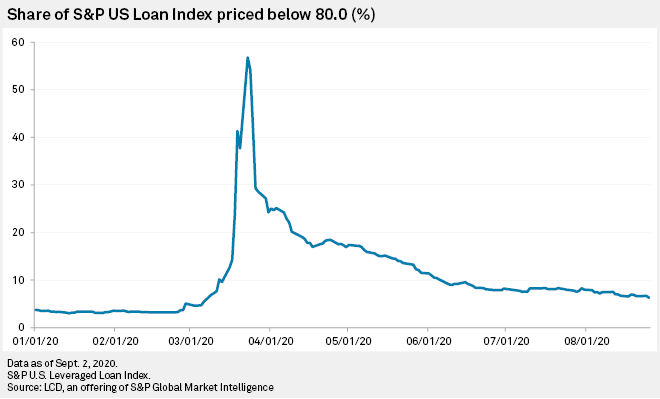

In the leveraged-loan market, the share of issues priced below 80%, a closely watched indicator suggesting a company is more likely to default, continued to grind lower, declining to 6.11% on Aug. 31 from 6.72% on Aug. 24.

|