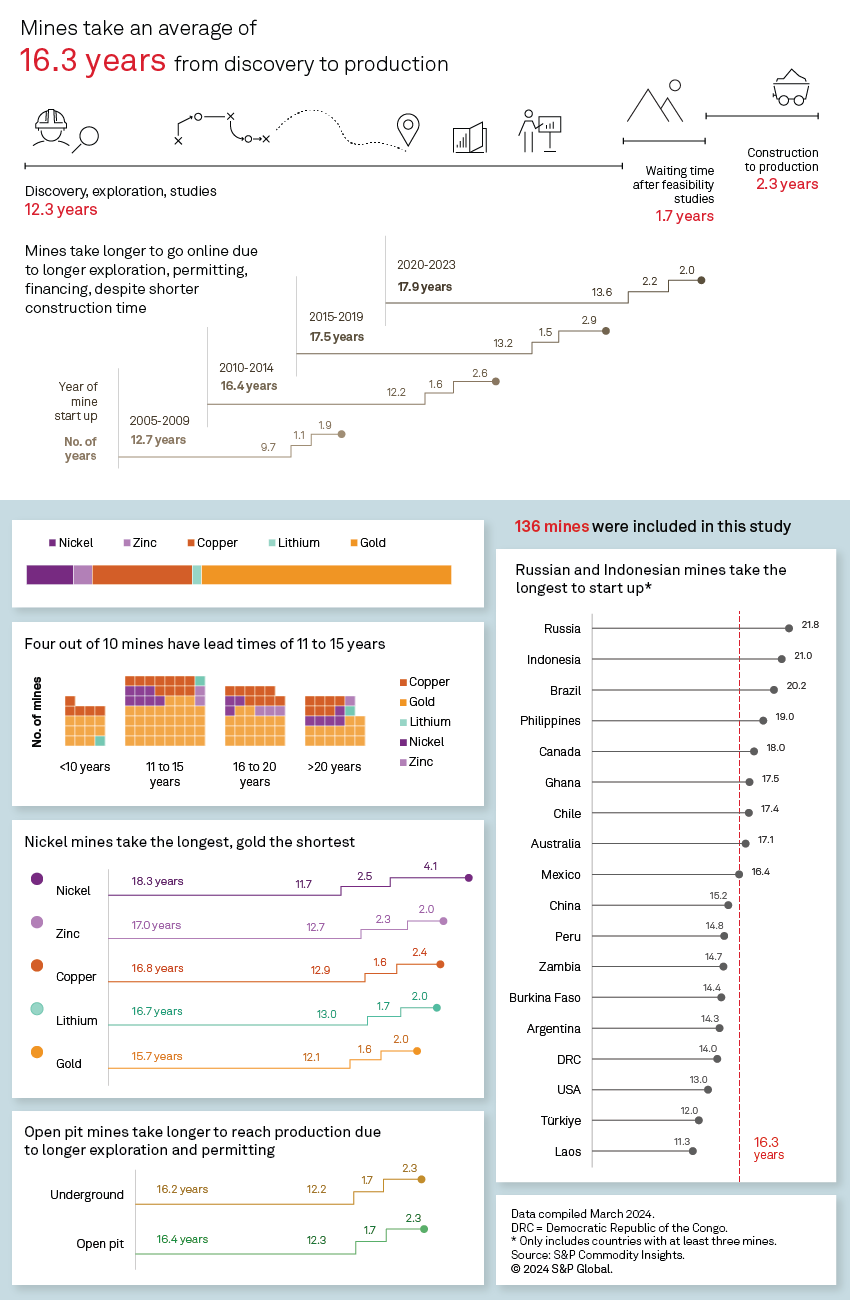

The average mine lead time continues to trend upward, reaching 17.9 years for mines coming online in 2020–23 compared with 12.7 years for mines that started up 15 years ago.

In this update of our previous article studying the lead time of mines — the interval from discovery to production — we have included several mines that started in 2023 and backfilled information on mines that started earlier. This study includes gold, copper, nickel and lithium mines that have begun production since 2000.

All the main points that we presented in our previous study have held true in this iteration. It takes an average of approximately 16 years for a mine to go from discovery of a deposit to startup. Open-pit mines have a longer average lead time than underground mines due to the longer exploration and permitting phases. Nickel mines have the longest lead time due to a longer construction period, amplified by several mines discovered in the mid-1980s and 1990s when lower nickel prices may have caused tighter access to capital.

Our research confirms the industry belief that lead times are getting longer. The average lead time for mines from 2005 to 2009 was 12.7 years, which has grown steadily up to the present. From 2020 to 2023, the average lead time jumped to 17.9 years, fueled by a longer exploration, permitting and studies phase and a longer period between the end of feasibility studies and the start of construction, which can be attributed to time spent obtaining financing and construction permits.

An example is the Bystrinskoye copper mine in Russia, which took 32 years from its discovery in 1986 to its startup in 2018. The mine completed its feasibility study in 2011, but being a public-private partnership between PJSC Norilsk Nickel, Chinese investors and the Russian government, it encountered several delays in securing funds. The Celestial mine in the Philippines was discovered in 1993 but did not begin production until 2022. The project underwent several ownership changes over the years and was delayed by difficulties in accessing capital.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.