Introduction

Sharp increases in interest rates should push bank bond portfolios further underwater in the second quarter of 2022, which will serve as a headwind to tangible book value growth.

While higher interest rates should support expansion in U.S. banks' net interest margins, the drastic increase in rates since the end of the first quarter will also negatively impact the values of most bonds that institutions own. Unrealized losses in the second quarter likely will increase from the first quarter and negatively impact tangible book value.

Surge in interest rates threatens bond portfolios

Bank bond portfolios have grown considerably since the pandemic began but many banks have been hesitant to deploy too much or at least purchase longer-dated securities, fearing that they would come under pressure as rates rise. Through the first quarter of 2022, deposit growth has outpaced loan growth by more than $4.5 trillion since year-end 2019. Banks have put large chunks of those funds to work in the bond market but have been hesitant to deploy too much cash or reach very far out on the yield curve as they expected interest rates to move higher.

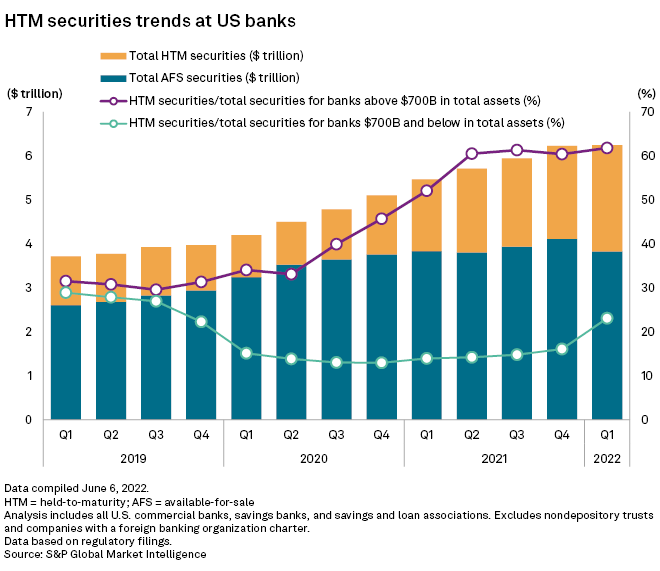

As interest rates rise, values of many of the bonds that banks own tend to come under pressure. All banks have to mark bonds sitting in available-for-sale, or AFS, portfolios on a quarterly basis. Those portfolios continue to hold the bonds owned by the majority of banks, though most of the recent expansion has occurred in held-to-maturity, or HTM, portfolios, which are not marked on a quarterly basis. Changes in the value of AFS portfolios flow through accumulated other comprehensive income, or AOCI, and impact tangible common equity.

Rates have risen notably since the end of the first quarter as elevated inflation persisted and the Federal Reserve signaled plans to more aggressively tighten monetary policy. The yields on the 2-year, 3-year and 5-year Treasurys have all risen more than 100 basis points since the end of the first quarter. Those moves should put even greater pressure on valuations in bank bond portfolios, which could limit future tangible book value growth.

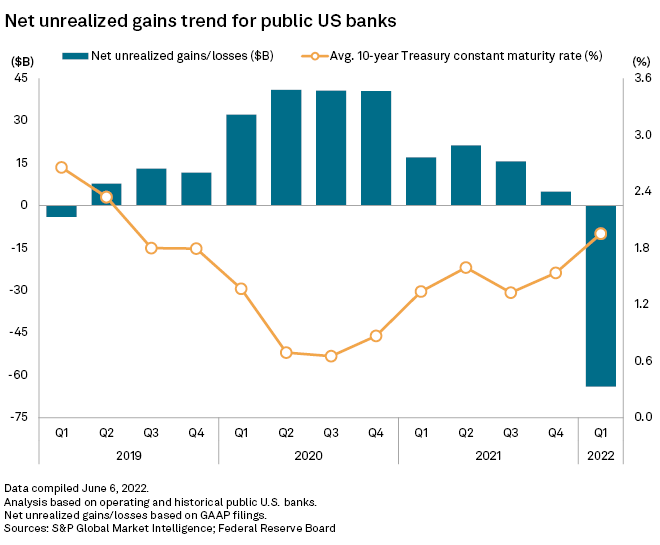

Many banks already reported pressure on tangible book value in the first quarter as the values of their bond portfolios plunged in the period. In the first quarter, institutions — including U.S. commercial banks, savings banks, and savings and loan associations that file GAAP financials — reported $64.14 billion in unrealized losses in their AFS portfolios, down substantially from $4.90 billion in unrealized gains in the prior quarter and $17.04 billion in the year-ago period. Those institutions saw their tangible book values in aggregate rise 0.7% from year-ago levels despite more than $41 billion in earnings in the period.

Some banks noted a few weeks ago that the negative AOCI impact might not be as great in the second quarter. Fifth Third Bancorp, for instance, said at an investor conference in early June that the AOCI impact through end of the May would be about "half the impact as the first quarter." However, since the end of May, the yields on the 2-year, 3-year and 5-year Treasurys have all risen more than 35 basis points.

Janney Montgomery Scott analyst Chris Marinac noted in a June 15 report that he expects further increases in rates to weigh on bond portfolio values once again in the second quarter. The analyst projected that regional banks could record a 5% decline in tangible book value in the second quarter.

Without including any impact from changes in AOCI, S&P Global Market Intelligence expects tangible common equity to grow by 4.4% year over year across the banking industry in 2022. However, after assuming a 5% negative hit stemming from potential changes in AOCI, the industry's tangible common equity would decline by 0.8% from year-ago levels.

Large banks leaning on held-to-maturity portfolios

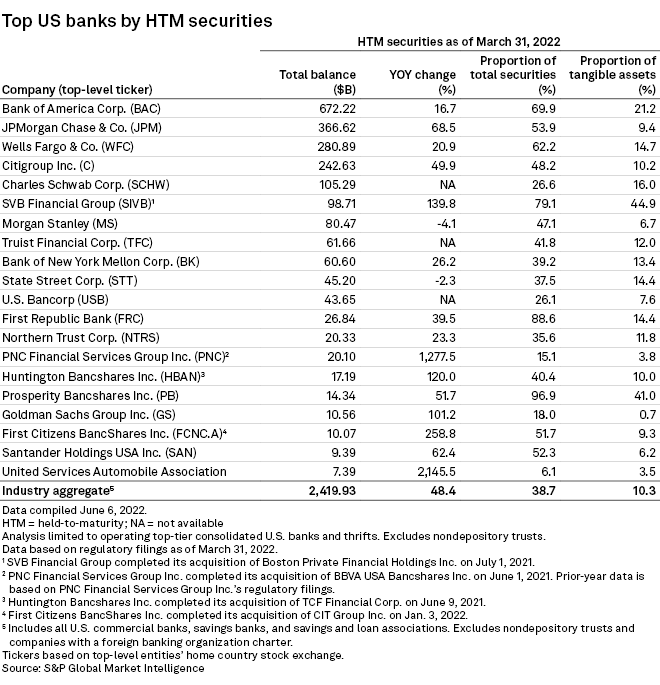

Some banks, particularly the nation's largest institutions, have sought to protect large portions of their securities portfolios from swings in the market by placing bonds in their held-to-maturity, or HTM, portfolios. For banks with over $700 billion in assets, changes in AOCI would impact regulatory capital in addition to tangible book value.

Large banks classified as U.S. global systemically important bank, or GSIB, holding companies — those with more than $700 billion in assets — have placed nearly 62% of their bond portfolios in HTM portfolios.

The growth in HTM portfolios at large banks has occurred while those institutions' securities portfolios ballooned during the coronavirus pandemic, growing more than 50% since the end of the first quarter of 2020.

Large banks appear quite mindful of a potential capital hit that could come with higher interest rates. Banks with over $700 billion in assets have grown their HTM securities 171% since the first quarter of 2020. At the end of the first quarter, HTM securities represented 61.8% of total securities at larger banks, compared to 60.4% in the prior quarter and 34.1% at the end of the first quarter of 2020.

Meanwhile, HTM securities at banks with less than $700 billion in assets have risen more recently, increasing to 23.1% of total securities in the first quarter from 16.1% in the prior quarter and 14.0% a year ago.

Across the banking industry, U.S. Treasury securities and securities issued by the government-sponsored enterprises comprised nearly two-thirds of HTM securities held by banks at the end of the first quarter.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.