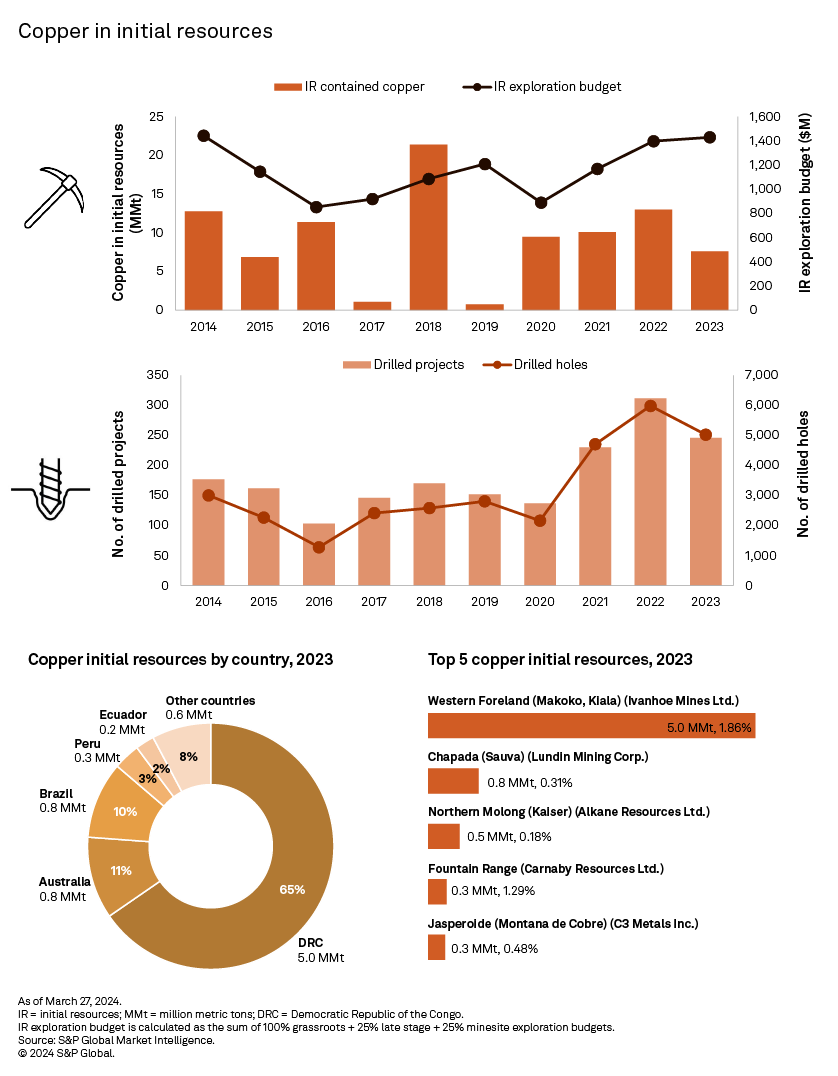

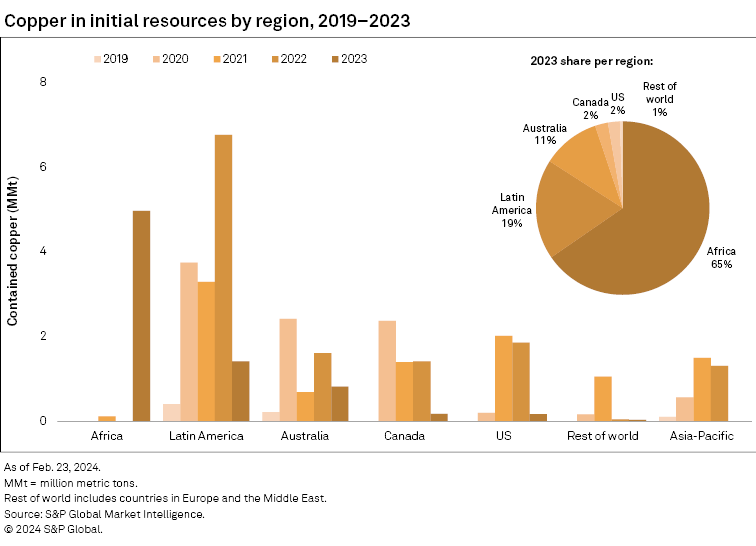

Metrics for copper in initial resources fell to four-year lows in 2023, reflected by the decrease in drilling activity in copper assets after two consecutive years of increases. Total contained copper in initial resources was 7.6 million metric tons across 20 announcements. Both total contained copper and the number of announcements represent the lowest values since 2019.

After a 30% increase in 2022, the trend for total contained copper in initial resources in 2023 reversed, falling 42% to 7.6 million metric tons across 20 announcements — a four-year low for both metrics. A lower grassroots exploration budget and a slowdown in drilling activity for copper in 2023 weighed down announcements of new copper, exacerbating the looming medium-term deficits in the copper pipeline.

Slowdown in drilling activity and share of grassroots exploration impact initial resources

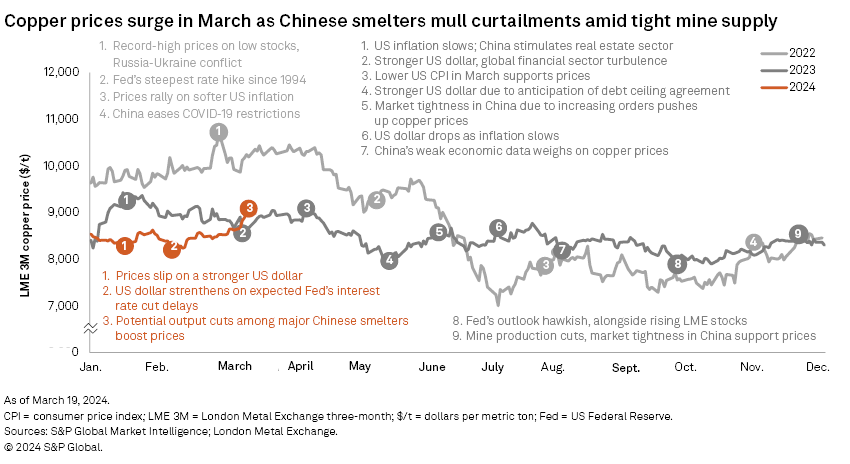

Copper prices spiked in 2021 to a record annual average in response to the post-pandemic economic recovery, but interest rate hikes, slower economic growth and the demand outlook weighed on the metal's prices in 2022 and 2023. The lower copper prices impacted funds raised by junior and intermediate companies for the metal, sliding over 50% to $2.3 billion in 2022 from $4.7 billion in 2021. Additionally, grassroots exploration for copper retreated in 2023, dropping 7% from 2022.

While exploration at mine sites and projects with existing resources can result in the discovery of new deposits, grassroots is the exploration stage most likely to result in an initial resource announcement. S&P Global Commodity Insights assumes that companies devote 100% of their grassroots budgets to discovering initial resources but only 25% of their late-stage or minesite exploration budgets.

Initial resource exploration budgets for copper increased a modest 2% year over year to $1.43 billion in 2023 — the highest total for the metal's initial resource-related exploration budgets since 2014. Much of this minor increase came from allocations to advanced assets, however. Grassroots exploration for copper was, in fact, the only stage to decrease in 2023, shrinking to 28% of total copper exploration budgets globally — the lowest share on record.

A more direct indicator of initial resources is the level of drilling activity. With grassroots exploration for copper at an eight-year high in 2022, drilling activity followed suit, with half of the projects drilled in the early stage of exploration. The total number of copper projects drilled that year is the highest in our records. Drilling activity slowed in 2023 as grassroots' share of the total copper budget fell to a record low, resulting in initial resource announcements and contained metal dropping to their lowest levels in four years.

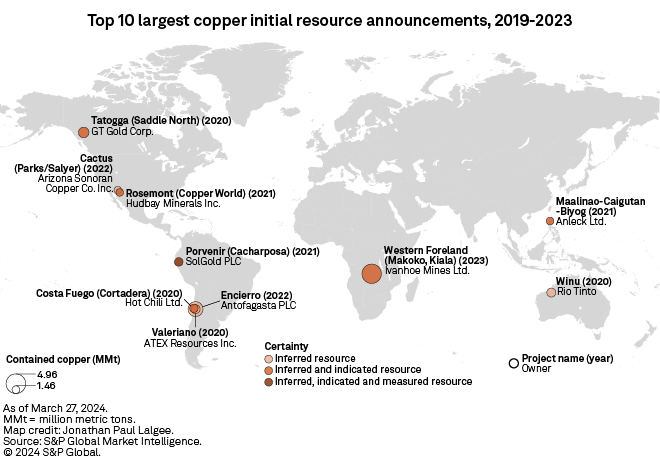

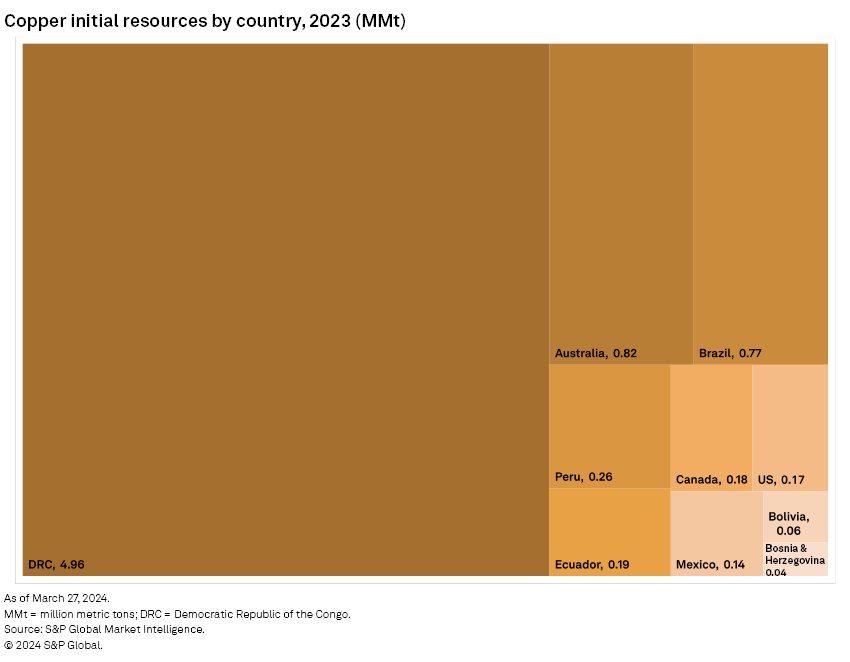

Only one 2023 announcement makes the 5-year top-10 list

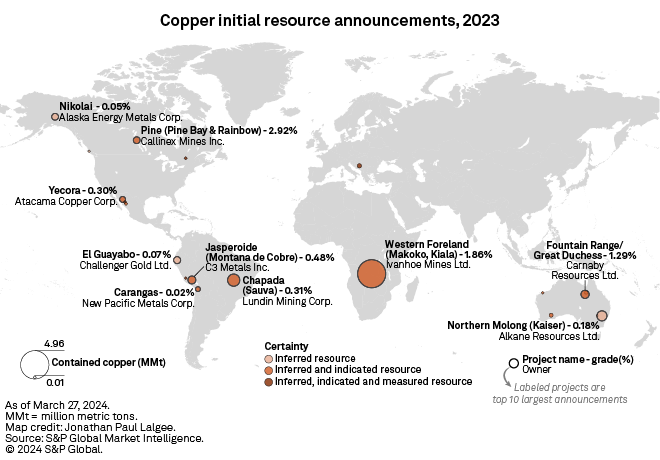

Only the largest announcement in 2023 made the list of the 10 largest announcements since 2019. In November 2023, British Columbia-based Ivanhoe Mines Ltd. announced inferred and indicated resources of 267 MMt containing 4.96 MMt copper in the Makoko and Kiala deposits of the company's Western Foreland project in the Democratic Republic of the Congo (DRC). This puts Western Foreland as the sixth-largest asset in DRC in terms of copper reserves and resources. In December 2023, Ivanhoe Mines closed a C$575 million private placement wherein part of the proceeds will be used for exploration purposes. In January 2024, the company restarted the project's diamond drilling program, focused on Makoko West and Kitoko.

The Sauva deposit within the Chapada mine in Brazil was the second-largest announcement in 2023. In February 2023, the sole owner, Toronto Stock Exchange-listed Lundin Mining Corp., announced an inferred and indicated resource of 250 MMt grading 0.31% Cu and 0.16 grams of gold per metric ton, containing 765,000 metric tons copper and 1.4 million ounces gold. This positions the Chapada mine as the asset with the second-largest copper reserves and resources in Brazil. After an exploration program conducted in 2023, Lundin Mining updated its mineral reserves and resources in Sauva in February 2024 to 25% above the initial resource announcement.

The third-largest announcement for 2023 was at the Kaiser deposit within the Northern Molong late-stage asset in New South Wales. In February 2023, Australian Securities Exchange-listed Alkane Resources Ltd. announced an inferred resource of 270 MMt grading 0.18% Cu, 0.24 g/t Au and 0.46 g/t Ag, containing 480,000 metric tons copper, 2.05 Moz gold and 3.97 Moz silver. Northern Molong has the third-largest copper reserves and resources in New South Wales.

Latin America records the most copper initial resource announcements in 2023

Regionally, Africa had the most contained copper in initial resources in 2023, but it all came from the Western Foreland project. Latin America recorded the highest number of announcements, with half of the top 10 largest announcements in 2023 in the region. At a country level, the DRC had the largest amount of contained copper, also attributed to Western Foreland. Australia followed with more than 800,000 metric tons of copper across six announcements. Latin America has always been the top explored region for copper, while Australia was the third-most explored country for the metal in 2023.

Looming supply deficits call for more exploration

The average contained copper and number of initial resource announcements have dwindled in recent years, as have recent copper discoveries, which does not bode well for the overall pipeline for the base metal. Our recent Commodity Briefing Service on copper anticipated that supply deficits on concentrates started in 2023 — sooner than initially expected — and are expected to last through the forecast horizon until 2028. Miners will need to invest more into generative exploration to meet the future demand for copper in an increasingly electrified world.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.