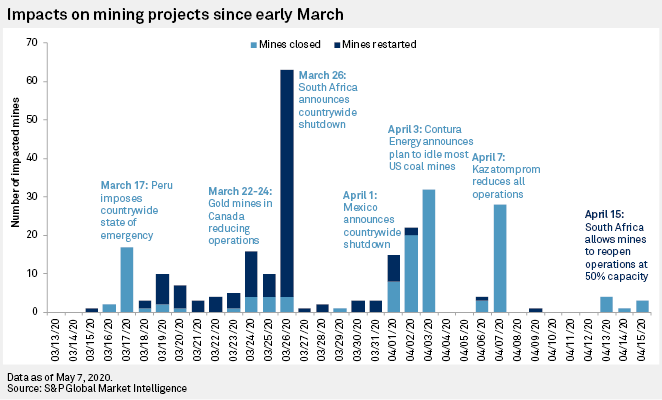

In this sixth article in our weekly series examining mines impacted by COVID-19, we have identified, at the time of compilation, disruptions to 265 mine sites in 34 countries. The number of mines being placed on care and maintenance has declined sharply since early April, and in recent weeks 130 mines have restarted, while operators of many others have framed near-term plans to resume operations. As the number of impacted mines drops off, our analysis will shift from tracking mine disruptions to estimating the impacts on production at the mine level and globally.

A running list of impacted assets can be found here.

Since the outbreak in China was first elevated to a public health emergency in January, S&P Global Market Intelligence has been monitoring and documenting worldwide mine closures. This is being completed on a best-efforts basis and may not include all assets impacted by the pandemic. Although Chinese mines were significantly affected beginning in January, limited reporting has been available on individual mines in the country.

At the time of writing, almost 50% of mines initially impacted have resumed operations, led by assets in South Africa and Canada. National and regional lockdowns remain in place for some impacted countries, but many governments are allowing mining operations to resume. The general Argentine lockdown has been extended to May 10, but mining has been declared essential, allowing mine sites to ramp up operations throughout April. Peru is still in its State of Emergency, which was recently extended to May 10, although the government has stated it will allow companies to gradually restart key activities during May.

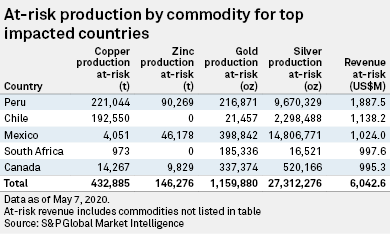

Using our at-risk production data, we have identified the at-risk revenue for the top five countries impacted. To date, Peru has the highest at-risk revenue at US$1.89 billion, including just over US$1.3 billion in copper revenue alone. Chile follows with US$1.14 billion, US$985 million of that in copper revenue. Mexico is close behind with US$1.02 billion of at-risk revenue — US$653.7 million in gold and US$222.7 million in silver. South Africa has US$997.6 million in at-risk revenue from palladium and platinum totaling US$567.2 million. Canada has US$995.3 million of at-risk revenue, with over half of that from gold production.

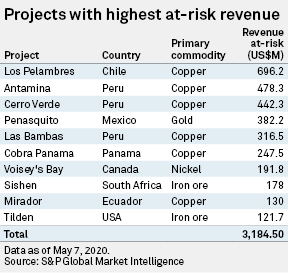

Delving deeper into the at-risk revenue, our analysis shows that the Los Pelambres copper mine in Chile has the greatest at-risk revenue of any project at US$696.2 million. The Antamina copper mine in Peru follows with US$478.3 million, and the Cerro Verde copper mine in Peru has US$442.3 million in at-risk revenue. Of the top 10 projects with the highest at-risk revenue, seven are in Latin America.

Based on our at-risk production estimates, we have identified which projects have the highest at-risk revenue for each commodity. The Penasquito mine in Mexico has the highest at-risk production of gold, silver and lead, valued at US$306.7 million. Voisey's Bay in Canada has the highest at-risk production of nickel and cobalt, valued at US$159.0 million.

As countries begin recovering from economic restraints, it is clear that COVID-19 will have a significant impact on 2020 revenue for miners and governments. Some companies will attempt to recoup lost production during the remainder of the year, while others will simply opt to leave the value in the ground, rather than sell at prices significantly reduced by the pandemic's demand destruction.

For additional insights on the relevant metal markets, see S&P Global Market Intelligence's most recent market outlooks for zinc, copper, nickel and iron ore.