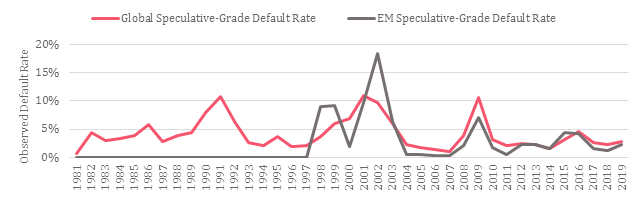

According to S&P Global Ratings research, the sudden stop to the global economy caused by COVID-19--and the drastic efforts to contain it--will lead to a global recession.[1] In S&P Global Ratings' view, this will likely mean a surge in defaults, potentially reaching a double-digit speculative-grade default rate for nonfinancial corporates in the U.S. and a material increase to high single digits in Europe over the next 6 to 12 months. Such surge in observed default date, should it materialize, equates with the previous spikes of default rates of S&P Global Ratings rated entities (figure 1 below) that we saw in 2009 (following the Global Financial Crisis), in 2002 (Tech Bubble), and in 1990 (a US economic recession). The impact to emerging markets will vary. Countries with greater exposure to tourism, commodities, U.S. dollar financing or that have larger external financial requirements will most likely see downward rating pressure, while others might be less exposed and better able to withstand the crisis.[2]

Figure 1: Global and Emerging Markets (EM) Trailing-12-Month Speculative-Grade Default Rate

Source: S&P Global Market Intelligence’s CreditPro®, data as of March 29, 2020

We use Credit Analytics’ CreditModel™ (CM), a statistical model, to assess the creditworthiness of 6125 financial and non-financial corporates based in Central Asia, European Emerging Markets, Middle East and North Africa (MENA), Sub-Saharan Africa, and the Indian sub-continent[3]. CM can generate credit scores for companies of all types including rated and unrated, public and private companies, globally. This becomes especially useful for our study that addresses a largely unrated market. We also use Credit Analytics Probability of Default Market Signal (PDMS) model, which uses stock price and asset volatility as inputs to calculate a one year Probability of Default (PD). This helps us understand which corporates have experienced significant changes in default risk, based on market-derived signals. We conducted our analysis by generating medians from PDMS based on both sector and regional clustering. Combining CM and PDMS for our study helps in (1) ranking entities in absolute terms according to their long-term view of credit risk and (2) in mapping these scores to one year PD based on derived market signals. [4]

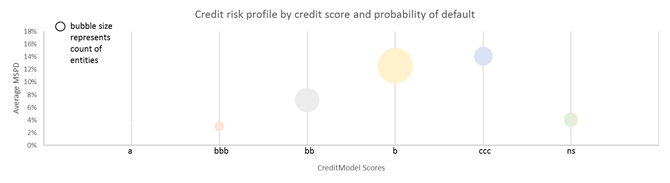

The credit landscape of our sample study is largely skewed towards the lower-end of the scoring spectrum (see figure 2 below). The bubble size in figure 2 represents number of entities with the highest frequency being for b-scored entities. Such concentration indicates high credit risk of entities composing our sample study. More importantly, lower scores are more susceptive to negative credit pressure that the current environment is producing. In its report titled “COVID-19 Credit Update: The Sudden Economic Stop Will Bring Intense Credit Pressure” published on March 17, 2020, S&P Global Ratings expected “Companies rated 'B-' and below will likely suffer most from financing needs and rapid rating transitions. […] These low ratings indicate a higher vulnerability to adverse business, financial or economic conditions. Companies with these ratings are most likely to lack the financial flexibility to weather a crisis hitting both their top-line revenue and financing costs.” [5]

The market, according to our PDMS model, aligns with the view translated by CM with increasing PD as we go down that scoring spectrum (from ‘a’ to ‘ccc’). The emergence and spread of Covid-19 globally naturally triggered a negative pressure on equity values worldwide and on the markets sampled in this study, which however was further exacerbated by the drop in oil prices that came on the back of Saudi Arabia and Russia failing to renew their agreement on oil production cuts. A significant number of countries in our sample study rely heavily on revenues generated from oil exports to finance their budgets, especially infrastructure investments. Economic growth in such oil-exporting countries is therefore highly sensitive to the oil price landscape leading to capital outflow and hence stress on equity prices, and ultimately the market derived likelihood of default.

Figure 2: Credit Risk Profile by Credit Score and Probability of Default

Source: S&P Global Market Intelligence, Credit Analytics CM as of December 31, 2019, Credit Analytics PDMS as of March 29, 2020

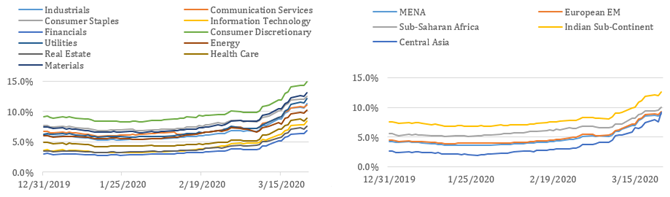

Looking at PDMS scores at the industry level (figure 3), we see that the highest risk is associated with Consumer Discretionary sector, a trend that is equally seen globally with investors fearing that non-essential spending will be severely hit. Materials and Industrials come second and third, respectively, in terms of PD and this is a result of weaker economic growth prospects but also reflective of the nature of most economies in the sample study: (1) being highly dependent on import of raw materials from global markets and exposing them to supply chain risks; and (2) high dependence on export of commodities (oil, minerals, etc.) which exposes them to economic risks. The sector ‘Financials’ has the lowest PDMS, unsurprisingly, with many academic and journalistic reports[6] classifying this crisis as corporate credit risk, which banks are, to an extent, mitigated against thanks to capital having been built up following the global financial crisis. In its report titled “COVID-19 Credit Update: The Sudden Economic Stop Will Bring Intense Credit Pressure” published on March 17, 2020, S&P Global Ratings expects “tighter funding conditions are unlikely to cause widespread problems for the banks we rate, but some nonbank financial institutions could face a more difficult year”.[7] Overall, though, all sectors show an increase in their PDs with a spike seen around late February 2020.

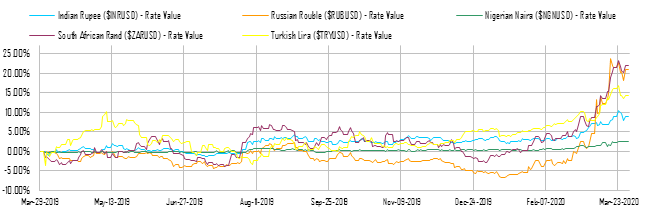

Looking at PDMS scores at the regional level (figure 4), we see a similar ascending trend across all countries with equally a consistency in the gap between the regions. Indian Sub-Continent based corporates, the majority of which are based in India, have the highest overall PD. Indian corporates form circa 55% of our sample study and the majority of them engage in high PD sectors, namely Consumer Discretionary, Materials, and Industrials, which compares unfavorably with, as a comparative example, our MENA sample having a concentration on low PD sectors, namely Financials. Nevertheless, even if we confine the analysis on an industry basis, we find Indian corporates with higher PD compared to other entities in our sample (for instance the average PDMS for Consumer Discretionary corporates in India is 21%, as of 29 March 2020, compared to 12% in MENA). This speaks of a more systematic risk with one hypothesis being that investors are fleeing capital markets in India and we find evidence for such argument in figure 5 below showing a clear depreciation of the Indian Rupee coinciding with the rise PDMS. The technical view here is aligned with the fundamental view presented by CM; S&P Global Ratings research also expects that extended shock to investor sentiment could result in heightened refinancing risk, especially for low rated issuers.

Figure 3: PDMS Evolution by Sector Figure 4: PDMS Evolution by Region

Source: S&P Global Market Intelligence, Credit Analytics PDMS as of March 29, 2020

Figure 5: Key Currencies Rate Value

S&P Global Market Intelligence, as of March 29, 2020

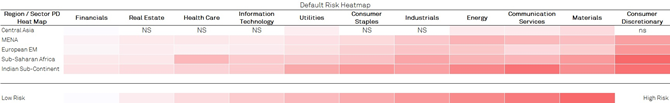

Following on the last point, we have developed a heat map showing average PDs across sectors and regions (figure 6). The heat map confirms, to a large extent, a common sentiment that investors are sharing across sectors. We see for instance low PD of Financials across all markets while Consumer Discretionary is, reciprocally, the highest.

Figure 6 PDMS profile per Region and Industry

Source: S&P Global Market Intelligence, Credit Analytics CM as of 31 December 2019, Credit Analytics PDMS as of 29 March 2020

S&P Global Market Intelligence research

"What’s the Market Sentiment Top Five Industries Impacted by COVID 19 from a Probability of Default Perspective", March 16, 2020

S&P Global Ratings research

- “Emerging Markets, Empty Streets and Risk Risks”, March 27, 2020

- “Assessing The Coronavirus-Related Damage To The Global Economy And Credit Quality”, March 24, 2020

- “The Oil And Gas Distress Ratio Hits Historic High On Global Fears And Price Volatility”, March 19, 2020

- “The Global Recession Is Likely To Push The U.S. Default Rate To 10%”, March 19, 2020

- “COVID-19 Macroeconomic Update: The Global Recession Is Here And Now”, March 17, 2020

- “COVID-19 Credit Update: The Sudden Economic Stop Will Bring Intense Credit Pressure”, March 17, 2020

- “Prolonged COVID-19 Disruption Could Expose The GCC's Weaker Borrowers”, March 11, 2020

- “Unrestrained Supply Swamps Oil Outlook: S&P Global Ratings Revises Oil & Gas Assumptions”, March 9, 2020

RatingsDirect® subscribers: Sign-in Here > to access the most up-to-date research from S&P Global Ratings.

External research

- “How coronavirus became a corporate credit run”, Financial Times, March 2020

[1] “COVID-19 Macroeconomic Update: The Global Recession Is Here And Now," S&P Global Ratings, March 17, 2020

[2] “COVID-19 Credit Update: The Sudden Economic Stop Will Bring Intense Credit Pressure”, S&P Global Ratings, March 17, 2020

[3] We chose listed entities in select developing markets; we managed to generate CM scores for 5638 entities while 487 remained unscored (“ns”) however they were associated with PDMS and hence we kept them in our study.

[4] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence CreditModel scores from the credit ratings issued by S&P Global Ratings.

[5] “COVID-19 Credit Update: The Sudden Economic Stop Will Bring Intense Credit Pressure”, S&P Global Ratings, March 17, 2020

[6] “How coronavirus became a corporate credit run”, Financial Times March 2020

[7] “COVID-19 Credit Update: The Sudden Economic Stop Will Bring Intense Credit Pressure” S&P Global Ratings, March 17, 2020