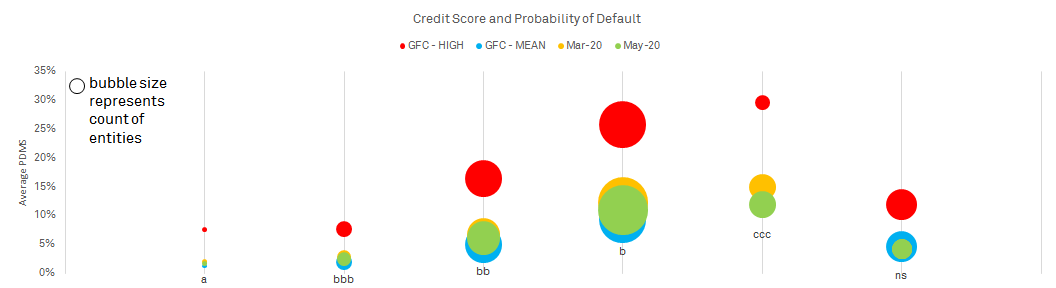

Default risk of companies in developing markets continued to lessen in May, according to our ongoing analysis using models from our Credit Analytics suite of credit risk tools. The credit stresses of corporates in developing markets peaked in March, when lockdowns were implemented and the COVID-19 breakout intensified. The improvement in the default prospects of our sample portfolio of developing markets since that time reflects an improvement in investor sentiment. In the last few weeks, economies globally started opening up following months of lockdown, which was a catalyst behind the change in investor sentiment. The probability of default (PD) still remains high in most markets sampled in this study, however, and the positive improvement in credit risk could easily be reversed should we see another surge in the number of Covid-19 cases. That said, as shown in Figure 1, the PD of our sample remains significantly lower than the peak-PD levels seen in the last Global Financial Crisis (GFC) of 2008-2009, and on par with the median PD levels of the GFC.[1] The potential for an increase in PDs is, therefore, still possible if the economic crisis is further accentuated.

Figure 1: Credit Risk Profile by Credit Score and Probability of Default

Source: S&P Global Market Intelligence Credit Analytics, as of May 27, 2020. For illustrative purposes only.

We used Credit Analytics’ CreditModel™ (CM), a fundamental scoring model, and PD Model Market Signal (“PDMS”), a structural PD model, to assess the creditworthiness of 6,158 financial and non-financial corporates based in Central Asia, European Emerging Markets (European EM), Middle East and North Africa (MENA), Sub-Saharan Africa, and the Indian sub-continent.[2] To better understand the models and the methodology employed in our study please refer to Appendix 1 - Models and Methodology Explained.

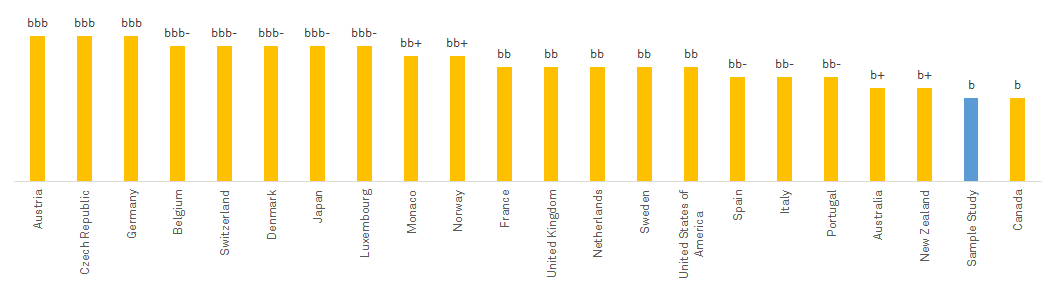

The credit landscape of our sample study, as shown in Figure 2, is largely skewed towards the lower-end of the scoring spectrum (that is, less attractive credit scores), indicating a generally high credit risk for entities within our study sample. This is because the scales are global in nature and are able to differentiate higher credit risk in emerging markets when compared to peers in developed economies. For instance, the median credit score of our sample companies is ‘b’ compared to ‘bbb’ for Germany corporates. Entities with weaker credit scores are more susceptible to adverse business, financial, and economic conditions, and could migrate to weaker credit scores, or perhaps even default on their obligations, should conditions not improve.

Figure 2: Credit Score Distribution – Developed Economies versus Sample Study for Developing Economies

Source: S&P Global Market Intelligence Credit Analytics, as of May 27, 2020. For illustrative purposes only.

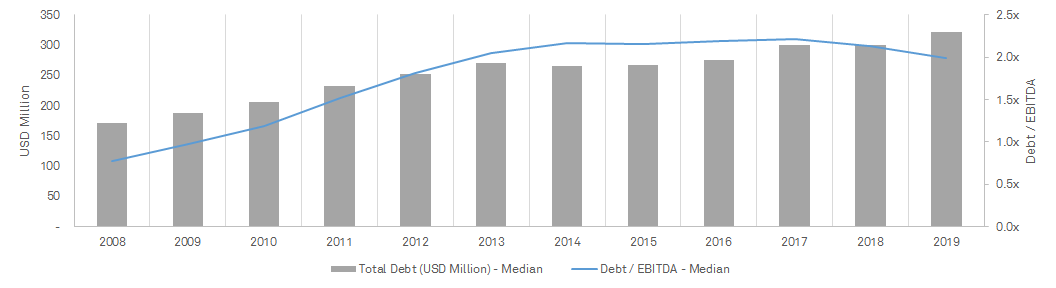

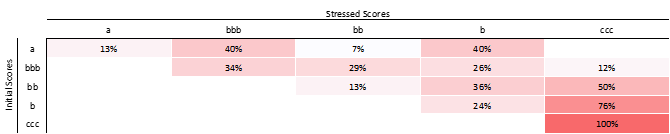

In the context of developing markets, weaker credit scores represent an even more important issue as a result of unprecedented capital outflow, rollover risk, and higher cost of funds, with credit spreads in emerging market peaking in late March to the highest levels seen since the GFC[3]. The last decade saw an extraordinary increase in leverage, with companies taking advantage of the lower cost of funds that came as a result of the GFC. This included our sample companies, as shown in Figure 3, with the median Debt/EBITDA at yearend jumping from close to 0.8x in 2008 to 2.0x in 2019. Similarly, the median Total Debt for the sample increased from USD $170 million to USD $300 million over the same period. The lockdown of economies will likely chip away at company earnings and further inflate leverage ratios. Figure 4 illustrates a stress-testing exercise where we applied a 25% haircut on the revenue of our non-financial corporates in the sample (circa, a sizable 5,000+ entities). Such a haircut may seem extreme, but given that lockdowns have been imposed for close to three months in most emerging markets, this potential loss seems possible. In this scenario, we see a significant negative migration of the sample companies, with 76% of ‘b-’ scored entities moving to ‘ccc’, and 50% of ‘bb’ entities moving to ‘ccc’.

Figure 3: Leverage Profile of Sample Companies – Excluding Financial Corporates

Source: S&P Global Market Intelligence Credit Analytics, as of May 27, 2020. For illustrative purposes only.

Figure 4: Credit Score Distribution – Developed Economies versus Sample Study of Developing Economies

Source: S&P Global Market Intelligence Credit Analytics, as of May 27, 2020. For illustrative purposes only.

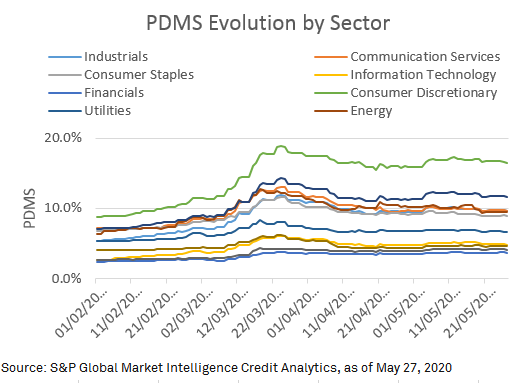

Looking at PDMS at the sector level, as shown in Figure 5, most sectors continue to display a high likelihood of default, with the highest risk associated with the consumer discretionary sector. This is a global trend, with investors fearing that non-essential spending will be severely hit. The materials sector presents the second highest risk, reflecting investor concern that this sector may suffer more than others, as well. Financials has the lowest PDMS, in part thanks to capital having been built up following the GFC. When assessing emerging market banks, S&P Global Ratings cites that, while these banks are “more exposed than developed market peers, [it] expects most will face an earnings rather than a capital shock, exacerbated by a lower investor appetite and increasing funding cost for systems dependent on external financing”.

Figure 5: PDMS Evolution by Sector

Source: S&P Global Market Intelligence Credit Analytics, as of May 27, 2020. For illustrative purposes only.

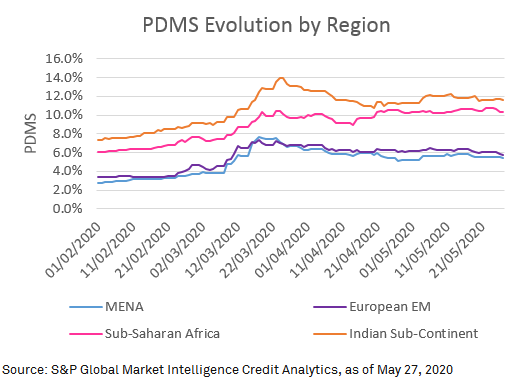

Looking at PDMS at a regional level, as shown in Figure 6, the gap that was present in late March between Indian-based corporates and their African counterparts has been reduced. Both regions show a significantly higher PD, however, when compared to MENA and Europe EM corporates.

Figure 6: PDMS Evolution by Region

Source: S&P Global Market Intelligence Credit Analytics, as of May 27, 2020. For illustrative purposes only.

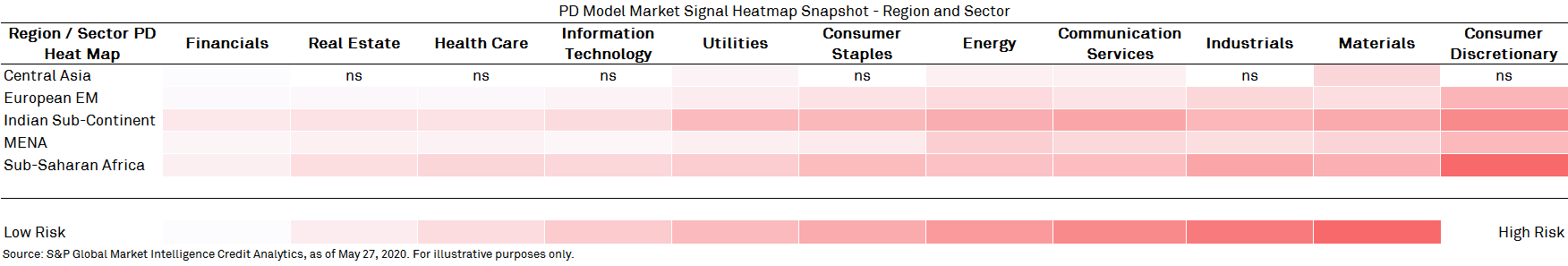

Figure 7 shows a heat map of average PDs across sectors and regions. The heat map confirms, to a large extent, a common risk sentiment that investors are sharing across sectors given the current environment.

Figure 7: PDMS Heatmap Snapshot - Region and Sector

Source: S&P Global Market Intelligence Credit Analytics, as of May 27, 2020. For illustrative purposes only.

Click here to learn more about our Credit Analytics tools used in this analysis.

Click here for complimentary access to the S&P Global Ratings research article mentioned in our report.

Appendix 1 – Models and Methodology Explained

Credit Analytics’ CM can generate credit scores for companies of all types, including rated and unrated, public and private companies, globally. This is especially useful for our study that addresses a largely unrated market. We also used the PDMS model, which incorporates stock price and asset volatility inputs to calculate a one-year PD. This helps us understand which corporates have experienced significant changes in default risk based on market-derived signals. We conducted our analysis by generating medians from PDMS based on both sector and regional clustering. Combining CM and PDMS for our study helps in: (1) ranking entities in absolute terms according to a long-term view of credit risk, and (2) mapping these scores to a one-year PD based on derived market signals.

S&P Global Ratings research

- “Financial Conditions Reflect Optimism, Lockdown Fatigue Emerges”, S&P Global Ratings, June 4, 2020

- “Historically Low Ratings in the Run-Up to 2020 Increases Vulnerability to the COVID-19 Crisis”, S&P Global Ratings, May 28, 2020

- “Risky Credits: Hanging On The Edge”, S&P Global Ratings, May 26, 2020

- “How COVID-19 Is Affecting Bank Ratings”, S&P Global Ratings, April 22, 2020

RatingsDirect® subscribers: Sign-in Here > to access the most up-to-date research from S&P Global Ratings.

[1] Credit scores generated by the Credit Analytics suite are shown in lowercase letters to differentiate them from credit ratings produced by S&P Global Ratings. S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence.

[2] We chose listed entities in select developing markets and managed to generate CM scores for 5,674 entities, while 484 remained unscored (“ns”). These entities were assessed by PDMS and a PD was generated and hence we kept them in our study.

[3] “Financial Conditions Reflect Optimism, Lockdown Fatigue Emerges”, S&P Global Ratings, June 4, 2020