451 Research is a technology research group within S&P Global Market Intelligence. For more about 451 Research, please contact 451ClientServices@spglobal.com.

Businesses are becoming attuned to responsibilities and customer requirements related to environmental responsibility. In many cases, they recognize that meeting those responsibilities — along with their own established targets for sustainability — will require significant technology investment in the years to come. However, those investments may be on hold for some organizations as current economic pressures exert themselves and drive organizations to prioritize other immediate operational concerns ahead of progress toward sustainability objectives.

Signals of enterprise intent paint a somewhat conflicting picture when it comes to sustainability efforts and the potential of those efforts to impact technology investment. Businesses are consistent in asserting that they have sustainability objectives, and that these objectives translate into expectations and criteria they bring to their relationship with technology vendors and suppliers. However, survey signals captured during the third quarter of 2023 in support of S&P Global's Tech Demand Indicator suggest that sustainability is currently one of the weaker influences on technology spending intentions. That spending may be coming, as organizations broadly acknowledge that meeting their sustainability goals will require a moderate to major investment over the next three years.

IT operations are a major contributor to environmental impact

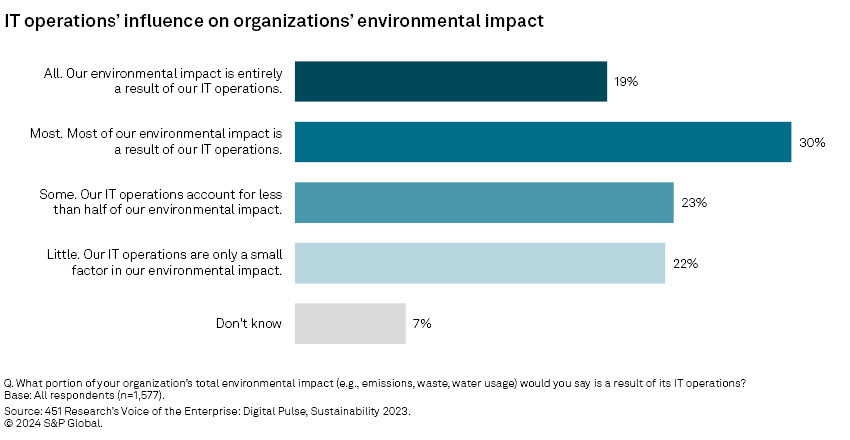

As organizations consider issues surrounding operational sustainability (and the extent to which IT can be a challenge to overcome or a tool for driving sustainability), the degree to which IT operations contribute to their overall environmental impact is a notable consideration. S&P Global Market Intelligence 451 Research's Voice of the Enterprise: Digital Pulse, Sustainability 2023 survey (which is fielded with a panel of IT decision-makers) shows a significant portion of surveyed businesses feel their IT operations are a major contributing factor to their environmental footprint.

Almost half of respondents say their IT operations account for most (30%) or all (19%) of their organizations' environmental impact. Notably, for organizations with IT footprints that are major factors in their environmental impact, IT presents both a significant opportunity for improvement (e.g., in the form of equipment power efficiency or operational efficiency for improved utilization). For these organizations, technology represents a significant potential to affect that environmental footprint.

It is highly unlikely that an organization's IT operations account for 100% of its environmental impact. What might seem like an overstatement on the part of nearly 20% of respondents may instead be a failure to understand or account for some non-IT factors. There are also several technology trends that may be contributing to the outsized perception of IT's impact on environmental footprint.

The changing dynamics of work is a likely factor. With more remote and hybrid workers, organizations are enabling workers to operate virtually to varying degrees, reducing the need for physical resources. More of the onus is being put on IT and technology offerings to provide the resources for employees. Digital transformation is another factor. As technology increasingly becomes the underlying engine of business operations, the perception may develop that more things are part of IT than in the past.

A growing focus on environmental impact

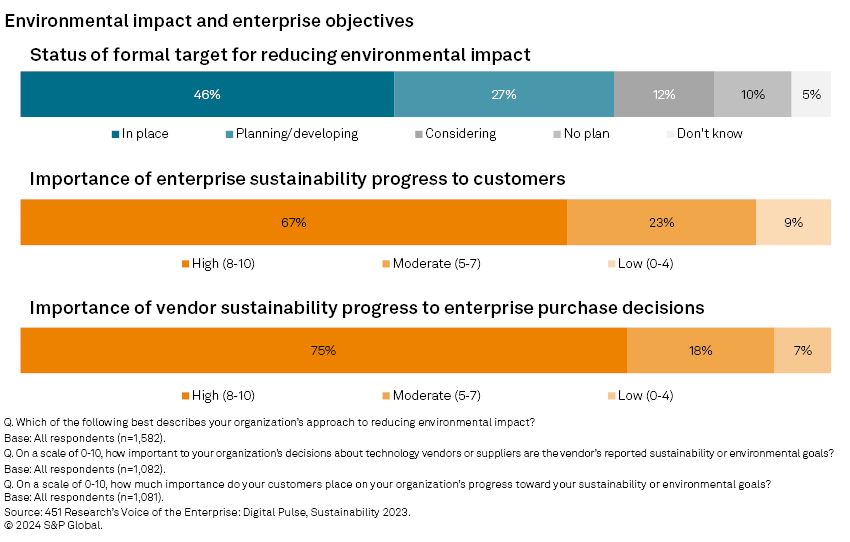

Enterprises are increasingly focused on the environmental impact of their operations and are actively engaged in efforts to reduce that impact, while also making assurances to the market about their targets and their progress toward achieving them. This focus plays a significant role in the relationships these organizations have with their customers and their technology vendors and suppliers, as both groups share in the motivations and outcomes of these sustainability commitments.

Almost three-quarters (73%) of respondent organizations say they have initiated or are developing formal targets for reducing environmental impact from their operations. A key factor driving the establishment of formal objectives is the attention customers are now paying to the sustainability efforts of companies they engage with. Two-thirds (67%) of businesses say their customers place a high level of importance (8-10 on a 10-point scale) on their progress toward environmental goals. Satisfying these expectations is likely to play an important role in customer retention going forward.

Attention from customers has in turn influenced how businesses view the sustainability efforts of the vendors and suppliers they have relationships with, as three-quarters (75%) of enterprise respondents rate vendor progress on sustainability targets as highly important to their technology purchasing decisions. The level of expectations businesses express for their vendors is notably higher than the level of expectations they perceive from their own customers, suggesting that businesses generally are further along in developing expectations surrounding sustainability than the larger consumer population. Now that customers and the market are paying closer attention to sustainability targets, businesses will continue to put pressure on vendors and suppliers to ensure their entire supply chain is meeting expectations.

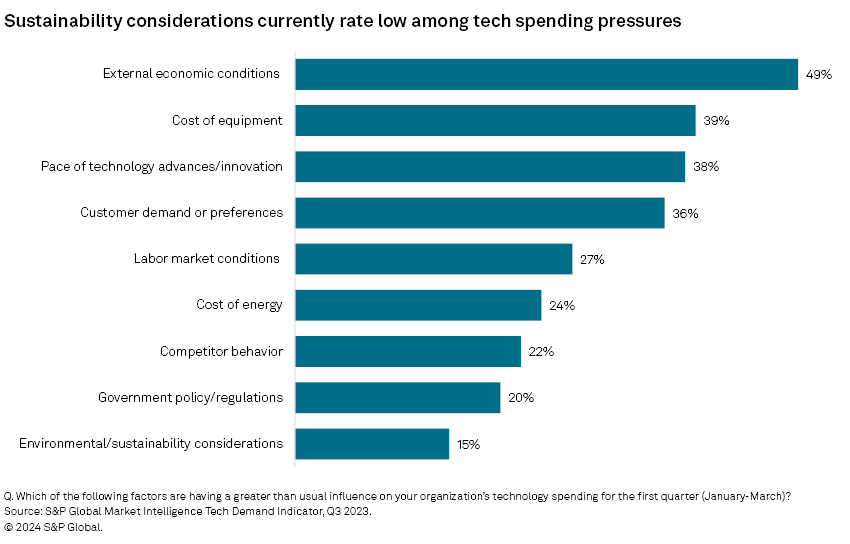

Sustainability, while a significant concern, may not stand out as a current spending focus

Although enterprises broadly point to formal sustainability targets as important to their customer and vendor relationships, most do not directly view sustainability as a key driver of technology investment in their organizations today. Respondents to one of the contributing third-quarter survey components of S&P Global's Tech Demand Indicator most frequently rate economic conditions (cited by 49% of respondents), equipment costs (39%), the pace of technology innovation (38%) and customer demand (36%) as currently having an outsized influence on their intent to spend on technology. Environmental considerations (15%) appear at the bottom of that list.

There is some nuance to this view. Resolving factors higher up on this list, such as the cost of energy and cost of new equipment, may have a direct impact on an organization's ability to meet its sustainability goals. In some cases, sustainability initiatives may not have an outsized impact on purchasing plans, because updating technology and services is naturally improving efficiency relative to the older technology and services being replaced.

Sustainability and environmental efficiency are frequently natural outcomes of tech decisions. While focusing on operational metrics, such as power efficiency and hardware utilization, is important, what ultimately makes financial sense for an organization's technology footprint is also going to be good for its environmental footprint.

During times of negative economic sentiment (the present moment included), macroeconomic forces and cost structures tend to rise to top of mind regardless of what positives may still be present. This is another factor in sustainability currently appearing to be a back-burner influence.

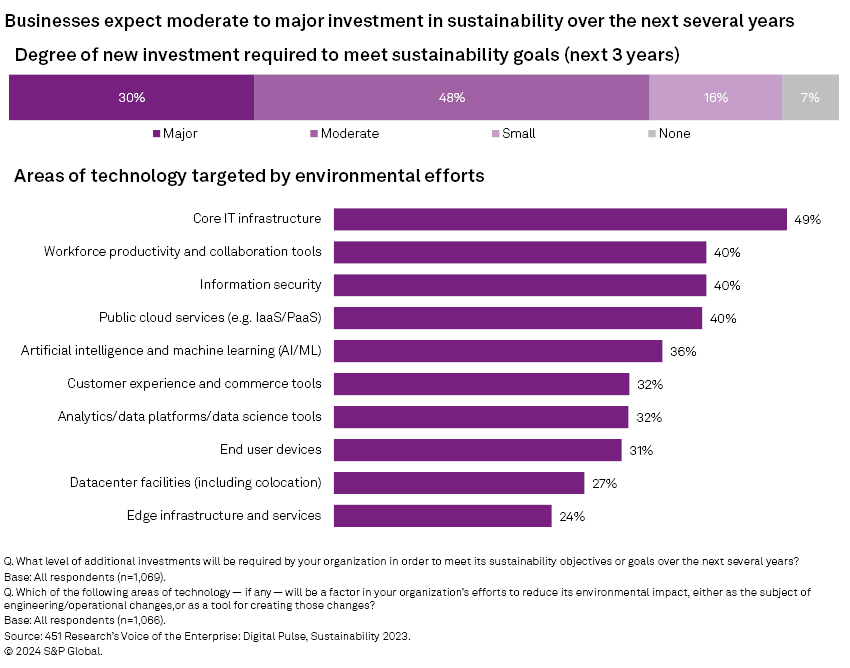

Businesses anticipate major sustainability spending in the next several years

Although organizations do not currently rate sustainability goals as having an outsized influence on technology spending plans, survey responses suggest a recognition that reaching sustainability objectives will require significant investment over the next several years. More than three-quarters of surveyed businesses say they expect to make moderate (48%) or major (30%) investments over the next three years to reach their sustainability goals.

The technology areas targeted by sustainability efforts span the breadth of an organization's technology footprint, with core IT infrastructure (49%) being seen as the most common area of improvement. Core IT infrastructure is cited most because it is both part of the problem and part of the solution. While IT infrastructure makes up a large share of the environmental footprint, updating associated technology and services not only reduces its impact, but also allows for gains in efficiency across the entire technology footprint.

The different areas of technology that factor into an organization's sustainability goals depend also on what systems are in use. Core IT infrastructure is also at the top of the list because it is used by virtually all businesses. Workforce productivity tools, information security and public cloud services are also high-use areas, which contributes to them being of higher significance than, for instance, edge infrastructure or datacenters that are used less frequently and thus at the bottom of the list.

Implications

Technology vendors and suppliers are aware of the increasing importance that sustainability efforts, and, more specifically, the sustainable capabilities of their offerings, have to the technology decision-making of their customers. However, survey results suggest sustainability's role as a driver of technology decision-making will increase during the next several years.

Many organizations have sustainability targets. However, if those targets are years in the future, some organizations may be willing to put spending in support of those efforts on pause during a time of considerable economic pressure.

That window is closing, and at the same time, there are signs that macroeconomic pressures may be easing — conditions that, together, suggest a greater emphasis on environmental impact in spending in the near future. Vendors that want to capture that spending will be under scrutiny for their capabilities, which include both the efficiency of systems and the availability of tools for measuring and improving that efficiency.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.