S&P Global Market Intelligence Kagan Consumer Insights surveys found little commonality between NBA fans in the US and how they access games versus those experiencing the NBA internationally. However, the data shows that, regardless of the continent on which one resides, being a basketball fan is generally synonymous with being a fan of NBA basketball.

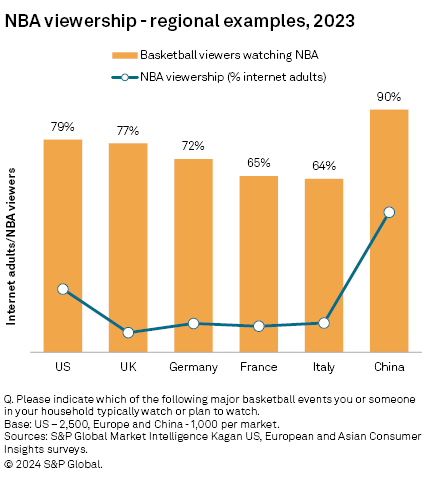

➤ The survey data show that 23% of online Americans watch the NBA, while viewership in Europe is at approximately 10%. However, these figures are dwarfed by viewership in China, where 52% of survey respondents said they watch NBA basketball games.

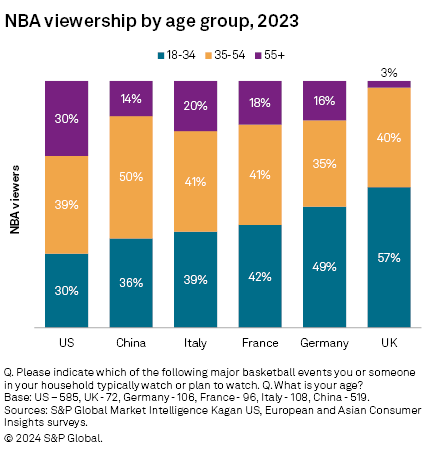

➤ Approximately one-third (30%) of NBA fans in the US are under 35 years old, while another 30% are over 55 years of age. Half of NBA viewers in China are aged 35-54. Europe tends to have a higher percentage of young adults who follow the NBA, especially in the UK, where 57% of respondents who watch the NBA are under 35 years old.

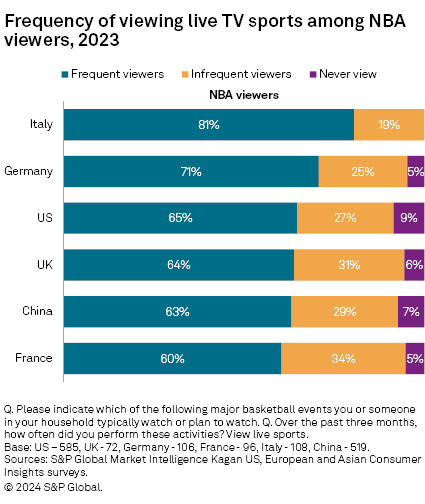

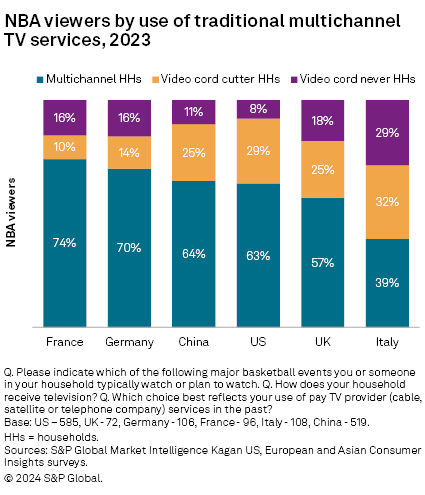

➤ Sixty percent to 80% of NBA fans across the six markets analyzed are avid sports fans who watch live TV sports at least once a week. There exists a strong correlation between NBA viewership and multichannel TV service usage.

➤ Being a fan of NBA basketball in Europe or China does not necessarily equate to following other American professional sports leagues.

Data from the Kagan Consumer Insights online surveys conducted in the US, Europe and Asia in 2023 show that viewership of NBA basketball varies from region to region. Six markets, including the US, the UK, Germany, France, Italy and China were selected for comparison purposes in this analysis.

In the US, 23% of internet adults reported watching the NBA, and 79% of basketball fans, overall, watch NBA games. In Europe, approximately 10% of internet adults cite watching NBA games. In the UK, where NBA viewing is the lowest (7% of internet adults), over three-quarters (77%) of total basketball fans said they watched NBA games. In comparison, in France and Italy, where professional EuroLeague basketball is popular, approximately two-thirds of total basketball viewers watch NBA games.

The survey data also show that a whopping 52% of internet adults in China watch NBA games, representing 90% of total basketball fans. Basketball is extremely popular in China, with a large percentage of viewers watching Chinese Basketball Association (CBA) league games. Considering its large population, China represents one of the largest international markets for the NBA.

The survey data reveal that the age distribution of NBA viewers in the US is significantly different from that in China and Europe. NBA viewership in the US is fairly evenly distributed across age groups, with 30% being young adults (18-34 years old) and another 30% being older adults (55 years and older). In China, NBA viewers tend to be somewhat younger, with half (50%) falling into the 35-54 age bracket and 36% being adults aged 18-34.

In Europe, where overall NBA viewing is lower than in the US, a higher percentage of NBA fans are young adults (18-34 years old). NBA viewing by young adults under the age of 35 ranges from 39% in Italy to 49% in Germany and 57% in the UK. NBA viewing by older adults (55 years and older) is almost nonexistent (3%) in the UK.

The survey data show that the majority of NBA fans across all six sample markets are men. For example, in Italy, 70% of NBA viewers are male, while the UK has the most balanced gender distribution, with 52% being male. In the US, 59% of NBA viewers are male.

Across all six markets, NBA viewership tends to be strongest among those who watch live TV sports at least once a week, also known as frequent live sports viewers. Italy has the highest percentage of these viewers watching the NBA (81%), followed by Germany (71%) and the US (65%). France and the UK have the highest percentages, 34% and 31%, respectively, of infrequent live TV sports viewers, or those who watch less than once a week, tuning in to NBA games.

The survey data also show a strong correlation between NBA viewership and the use of multichannel TV services. For instance, in France and Germany, about seven in 10 NBA viewers subscribe to a cable, satellite or IPTV multichannel service. Both markets have relatively few video cord-cutting households and a slowly growing percentage of young adults who have never subscribed to a multichannel TV service, also known as video cord nevers. Only 39% of NBA viewers in Italy have a multichannel TV service subscription, which is still significant considering that only 29% of internet households subscribe to a traditional pay TV service.

Nearly two-thirds (63%) of NBA viewers in the US still subscribe to a multichannel TV service, despite the overall use of traditional pay TV services dropping to 51% in fall 2023. However, 29% of NBA viewers have dropped their traditional multichannel TV service, and another 8% are video cord nevers, which mostly rely on online services for access to NBA games.

How NBA games are accessed also varies greatly by region. For instance, in the US, live NBA games are carried on numerous cable TV channels such as ESPN and TNT, as regional sports networks (RSNs), national TV broadcast networks and the NBA Network cable channel. NBA games can also be accessed online using virtual multichannel TV services such as YouTube TV, the NBA League Pass/Team Pass app and RSN online services such as Bally Sports+.

Across Europe, NBA games can generally be accessed online using the NBA League Pass/Team Pass apps. In the UK, NBA fans can also watch live games through TNT Sports (formerly BT Sports) or the Discovery+ online service (carrying TNT Sports broadcasts). In France, NBA games are broadcast on Canal Plus and beIN Sports. DAZN carries NBA games in Germany and SkySports broadcasts NBA games in Italy. In China, NBA games can be accessed online through Tencent Sports or Migu.

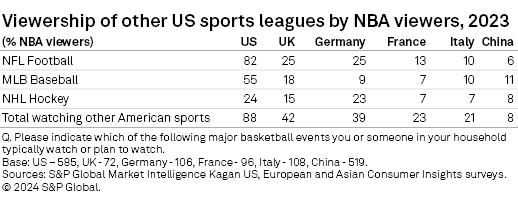

The US survey data shows that 88% of NBA viewers watch other professional sports leagues, such as the National Football League, Major League Baseball and National Hockey League. The data reveals that 82% of NBA fans also watch the NFL, 55% watch MLB baseball and 24% watch NHL hockey.

Outside the US, far fewer NBA basketball fans follow other American professional sports leagues. The UK has the strongest ties to other American sports leagues with 42% of NBA fans watching another American sport. Not far behind, 39% of NBA viewers in Germany watch at least one other American sports league. The data also highlights that few NBA viewers in China (8%) watch other American sports leagues.

The Kagan Q3 2023 US Consumer Insights survey was conducted in September 2023 consisting of 2,500 internet adults. The survey has a margin of error of +/- 1.9 ppts at the 95% confidence level. The Kagan 2023 European Consumer Insights survey was conducted in December 2023 consisting of 1,000 internet adults per country in the UK, France, Germany, Italy, Sweden and Poland. Each survey has a margin of error of +/-3 ppts at the 95% confidence level. The Kagan 2023 Asia Consumer Insights survey was conducted in June 2023 consisting of 1,000 internet adults per country in China, South Korea and India. Each survey has a margin of error of +/1 3 ppts at the 95% confidence level. Percentages are rounded to the nearest whole number. Survey data should only be used to identify general market characteristics and directional trends.

To submit direct feedback/suggestions on the questions presented here, please use the "feedback" button located above, directly under the title of this article. Note that while all submissions will be reviewed and every attempt will be made to provide pertinent data, Kagan is unable to guarantee the inclusion of specific questions in future surveys.

Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.