Latin America and the Caribbean saw fixed residential broadband connections increase 8.4% in 2023, reaching 53.7% of occupied households in the region. Growing connectivity needs and internet service providers' push to reach new markets in large countries such as Mexico and Brazil led to a faster deployment of services.

According to S&P Global Market Intelligence Kagan's forecast, the penetration will expand to 56.4% of occupied households by 2024.

Fiber-to-the-home (FTTH) connections led the way, rising 21.2% year over year to reach 62.9 million households across the region and reflecting a market share of 56.3%. Our models project that FTTH market share will jump to 60.1% by year-end.

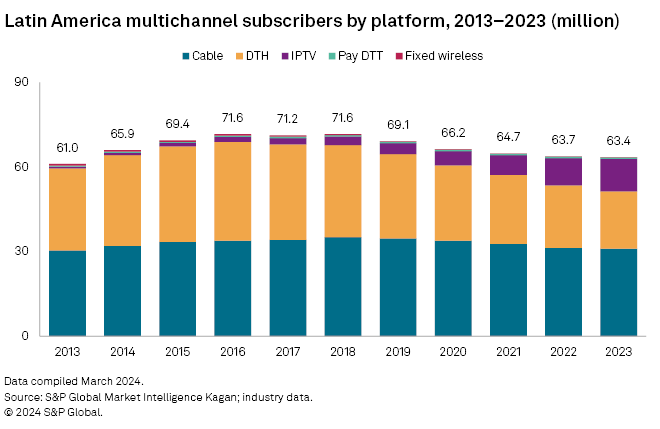

On the flip side, traditional pay TV services declined 0.4% in 2023, according to Kagan estimates, ending the year with 63.4 million subscriptions, or 33.3% of TV households, as the growing availability of streaming options has sapped the segment's strength. Subscriptions will decline to 32.8% of TV households by the end of 2024.

The Take

- Residential fixed broadband subscriptions increased 8.4% across Latin America and the Caribbean during 2023, reaching an estimated 111.7 million households, or 53.7% market penetration.

- FTTH connections, which became the lead internet platform for Latin America in 2022, grew 21.2% year over year to reach 62.9 million, or 56.3% of the regional fixed residential broadband market in 2023.

- Penetration rates for fixed broadband vary wildly across the region. Among the five largest markets by population, Argentina comes top in terms of residential broadband penetration at 77.6%, followed by Mexico (71.9%), Colombia (55.3%), Brazil (54%) and Peru (35.4%).

- Traditional pay TV services continue to lose the battle against streaming, decreasing 0.4% annually in 2023 to 63.4 million subscriptions, or 33.3% of TV households across the region. The market shrank 11.4% since its heyday in 2016, when Latin America's pay TV subscriptions reached 71.6 million.

Fixed broadband grows fast in LatAm, boosted by FTTH

Latin America's residential fixed broadband penetration continued to see accelerated growth rates in most geographies during 2023, with an 8.4% year-over-year rise over 2022, reaching 111.7 million households during the year and reflecting a nearly 54% penetration, led by the fast deployment of services across large markets such as Mexico, Colombia and Brazil and more than doubling in size over the last 10 years.

The market, led by large global players such as América Móvil, Liberty Latin America, Telefónica and Millicom, as well as by several rapidly growing smaller players mostly in Brazil, has been propelled over the last few years by the expansion of FTTH services, which by the end of 2023 accounted for nearly 63 million subscriptions, or 53.6% of all residential fixed line broadband connections across the region, which has 665 million inhabitants.

Kagan forecasts point to a residential fixed broadband market of 119.2 million subscribers by the end of 2024, a 6.7% year-over-year growth, reaching 56.4% of the households, with a seven-year compound annual growth rate (CAGR) of 3.9% to 2030.

By 2030, we forecast that 63.6% of all Latin American and Caribbean households (146.1 million) will have a subscription to fixed broadband internet.

Fiber in fast lane

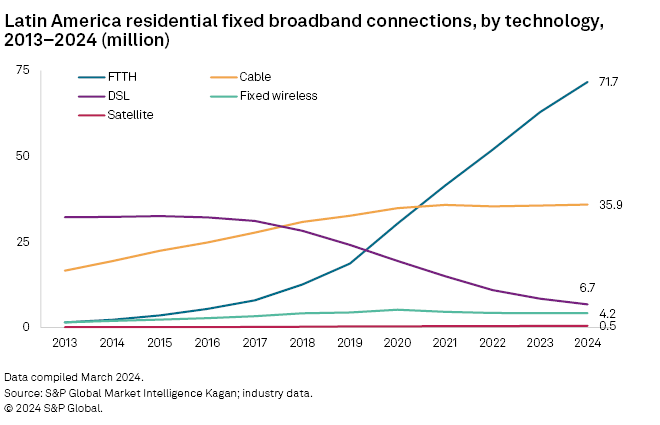

Fiber optic became the leading technology for household internet in Latin America and the Caribbean in 2022, with 50.4% of connections, and it continues to outpace other platforms such as cable and fixed wireless broadband. Platforms such as satellite service remain niche options despite the presence of large global players, including Hughes and Starlink.

According to Kagan data, FTTH is expected to reach 71.7 million connections by the end of 2024, with a 60.1% market share.

Fiber growth has outpaced all other platforms over the last few years. By 2023, the 10-year CAGR for FTTH stood at 45.6%.

Hybrid fiber-coaxial (HFC) broadband remains the second most common broadband platform, at 35.6 million subscribers in 2023, or 31.8% of the market. HFC subscribers are expected to reach 35.9 million by the end of 2024 but could reduce its market share to 30.1%, outpaced by the expansion of FTTH.

Legacy DSL connections, Latin America's dominant internet platform until 2017, have decreased steadily as companies deploy new cable and fiber-optic networks. At the end of 2023, DSL represented only 8.4 million subscriptions or 7.5% of all household connections. Several countries including Argentina, Bolivia, Brazil, Uruguay and Paraguay, are expected to phase out DSL completely before the end of the decade, and it has contracted at a 12.6% 10-year CAGR since 2013.

Fixed wireless broadband, seen as a low-cost alternative to wireline connections, ended 2023 with 4.2 million subscribers across the region (a 3.8% market share) and is expected to remain stable during 2024. The segment grew at a 10.8% CAGR in the 10 years to 2023 and is expected to end 2030 with 4.5 million subscribers, hampered by lower comparative download speeds and more restrictive data caps compared to other fixed broadband options, despite the growing deployment of 5G services across several countries.

Meanwhile, satellite internet connections, usually seen as an expensive solution for remote areas across Latin America, expanded at a healthy 28.6% 10-year CAGR until the end of 2023. However, its niche nature and high installation costs have kept the subscriber base low. Satellite internet had an estimated 420,428 subscribers in 2023, and is expected to grow by 7.9% by the end of 2024 to 453,566 subscriptions.

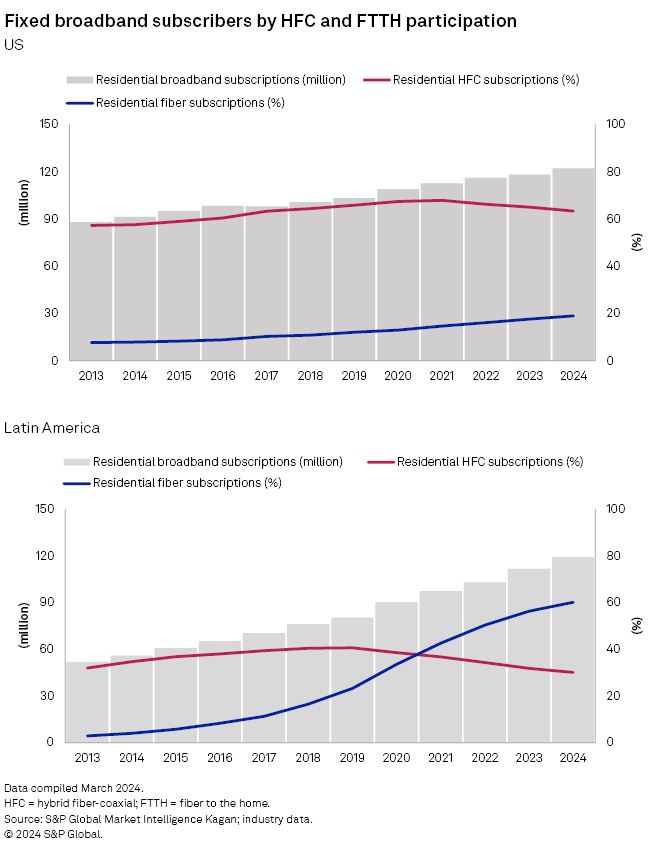

The fast advance and high penetration of FTTH services in the region contrasts with the US, where HFC remains the most popular platform. Despite being a larger market in terms of subscriptions than the whole of Latin America combined, with 118.3 million subscribers at the end of 2023 (an 88.5% market penetration), coaxial cable stood at nearly 77 million subscribers in 2023, or 65% of the market, while FTTH, despite growing at a 12% rate every year between 2013 and 2023 — four times faster than the market as a whole — currently serves 20.9 million subscribers, 17.7% market participation.

Markets grow unevenly across region

Despite the fast growth across the board, not all markets in Latin America and the Caribbean are alike, as penetration rates and predominant platforms vary between neighboring countries.

Brazil was the largest of the markets with 40.4 million fixed residential broadband subscribers at the end of 2023 (54% household penetration). Brazil ended the year with a 74.9% market participation for FTTH, aided by the expansion of several national and regional-level smaller internet service providers over recent years. HFC held a distant second place, accounting for 20.2% of the subscriptions.

Just south of the Brazilian border, Argentina, Latin America's fourth-largest market by population, ended 2023 with 11.3 million residential broadband subscriptions, or a 77.6% market penetration, of which HFC comprised 56% and FTTH 32.7%.

Mexico closed 2023 with 27.1 million residential fixed broadband subscriptions, or 71.9% of households, of which 61% were FTTH connections and nearly 28% were HFC. Meanwhile, Colombia, third in the region by population, ended 2023 with a 55.3% fixed broadband penetration (9.8 million households), with 54.5% cable market participation, followed by FTTH at 33.3%.

Peru, with 3.4 million fixed broadband households, reached only a 35.4% fixed broadband penetration in 2023, with HFC services taking 59.8% of the pie, followed by 31.9% for FTTH. The country is expected to cross the 50% fixed broadband penetration mark by 2028, with 5.4 million subscriptions, according to Kagan forecasts.

Traditional pay TV keeps shrinking under pressure from OTT

As the fixed broadband market keeps expanding across the region, traditional multichannel services have continued to slowly lose favor with the Latin American and Caribbean consumer, as faster and more widespread internet access has allowed the propagation of an increasing number of over-the-top services independent of pay TV providers, fostering cord cutting.

In 2023, Kagan data shows that multichannel services decreased 0.4% over 2022 to end at 63.4 million subscriptions across the region. It has contracted 11.4% since 2016, when it reached its highest access level at 71.6 million subscribers. By the end of 2024, our forecasts point to an additional 0.15% decline to end at 63.3 million subscriptions.

Service penetration, which topped 2016 at 42% of TV households, declined to 33.3% in 2023 and is expected to drop to 32.8% by the end of the year. We forecast the market to continue to contract at a 0.2% negative CAGR between 2023 and 2030, with multichannel services ending the period at 62.6 million.

Coaxial cable services remain the largest platform for pay TV services in Latin America at nearly 31 million subscriptions and 48.9% of the market, followed by direct-to-home (DTH) satellite with 32.1% of the pie, or 20.4 million subscriptions. Fiber-based IPTV services, at 11.5 million subscribers, take up the third spot with 18.1% of the market, while the remainder of the market is taken up by pay digital terrestrial television (DTT) services — a rarity in the region — and legacy microwave-based fixed wireless service.

Cable is expected to remain Latin America's leading multichannel platform by 2030, with a 48.4% market participation (30.3 million subscriptions), followed by IPTV services with 25.3% of the market (15.9 million subscriptions), just overtaking DTH with a 25% participation, and 15.6 million subscriptions.

OTT services keep growing

As the traditional pay TV market keeps shrinking across the board, Latin Americans have, however, embraced OTT services, taking advantage of the availability of high-speed broadband and comparatively lower access fees.

Netflix Inc. for example, closed 2023 with 45.9 million subscriptions in the region after adding 4.3 million new subscribers during the year, for a 10.3% expansion of its Latin American footprint. Most global OTT platforms, including Disney+, HBO's MAX, Paramount+ and Apple TV, and regional platforms such as Claro TV and VIX, already have a presence in the region.

Mexico remains the largest multichannel market in Latin America with 18.2 million subscribers in 2023 (28.7% of the region) and a 52.2% penetration of TV households. The market is led by cable services, led by local market leaders Grupo Televisa and Megacable, with 37.4% of the subscriptions (6.8 million), followed by satellite DTH with 32.5% (5.9 million subscribers) and IPTV with 5.5 million subscribers, or 30.1% participation.

Kagan forecasts a 0.8% market contraction by 2024, led mostly by a 13.5% decline in DTH subscribers, as the segment's inherent difficulties in providing double and triple-play bundles with broadband led customers to select more broadband-friendly platforms. By 2030, Mexico's market is expected to have contracted at a negative CAGR of 1.9% over 2023.

After Mexico, Brazil is the second-largest multichannel market in Latin America with 10.2 million subscribers as of 2023, followed by Argentina (9.7 million), Colombia (6.7 million) and Chile (3.2 million) pay TV accounts, according to Kagan data.

Already a client? Click on the link to access the full article.