![]()

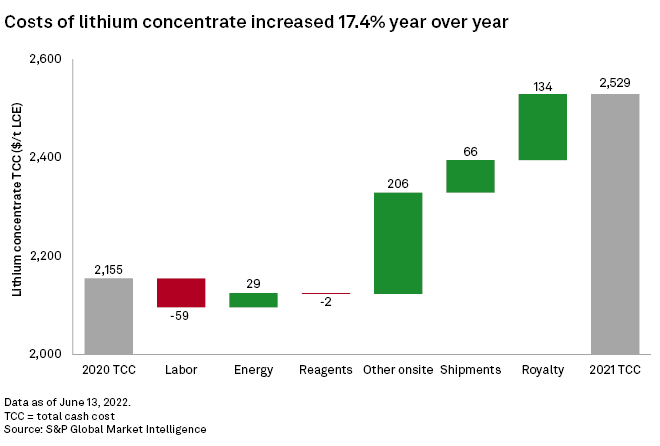

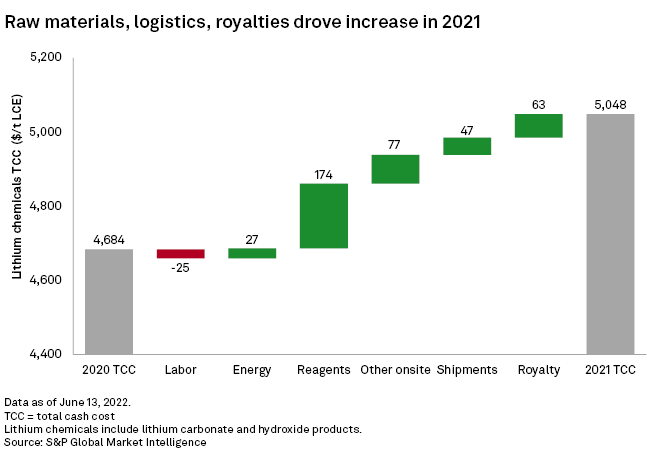

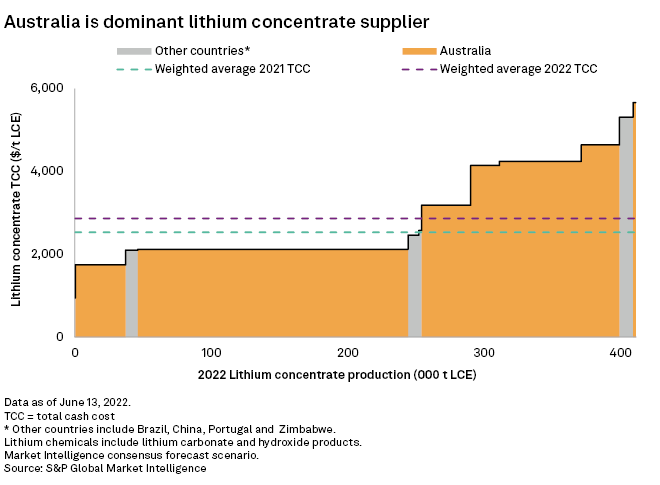

* In 2021, total cash costs of lithium concentrate rose 17.4% year over year and of chemicals rose 7.8% year over year.

* A limited increase in energy costs against the backdrop of rising oil prices suggests promising results from lithium producers' efforts on the energy transition and emissions control.

* Raw materials and logistics costs, along with inflation, are putting upward pressure on reagent and shipment costs.

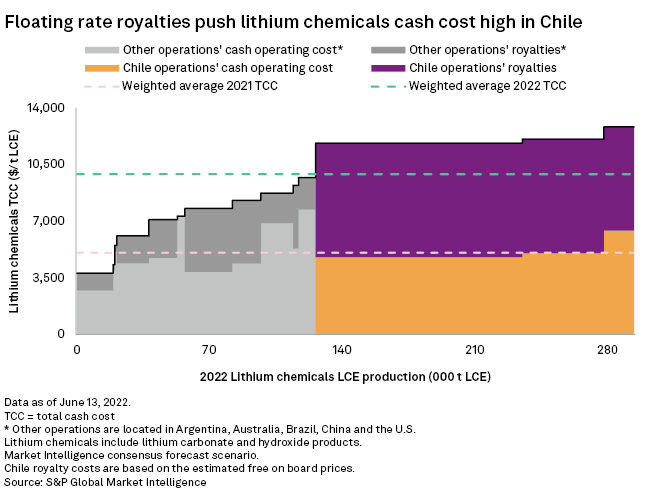

* Chilean lithium producers' total cash costs will almost double in 2022 due to increased royalty payments.

Lithium prices skyrocketed in the December 2021 quarter after gently ramping up earlier in the year. The Battery-grade Lithium Carbonate EXW China price closed at $41,925 per tonne at year-end, an increase of 485.8% year over year . Against a backdrop of soaring prices, costs of lithium extraction from hard-rock ores and brines also rose. According to S&P Global Market Intelligence data, total cash costs of lithium concentrate operations increased 17.4% year over year to $2,529/t lithium carbonate equivalent, or LCE. Total cash costs of lithium chemicals — lithium carbonate and lithium hydroxide products — increased from $4,684/t LCE in 2020 to $5,048/t LCE in 2021. Looking at each component of total cash costs, we found that raw materials and logistics were the main drivers of cost increases.

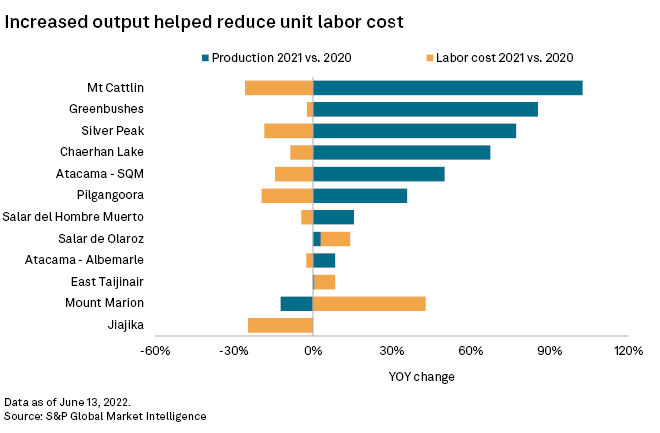

Labor costs of lithium concentrates declined by $59/t LCE and labor costs of chemical products declined $25/t LCE in 2021. S&P Global Market Intelligence's Connect platform suggests dollar-value hourly wages of the mining segment in major lithium-producing countries increased year over year in 2021; for example, hourly wages were up 10.9% in Australia and 12.1% in Chile. Expanding production has offset the higher labor cost. Concentrate production rose 85.5% year over year at Western Australia's Greenbushes mine, 35.8% at the Pilgangoora mine and 102.5% at the Mount Marion mine. Unit labor costs decreased 2.3% for Greenbushes, 19.5% for Pilgangoora and 25.8% for Mount Marion over the same period. In Chile, Albemarle Corp. and Sociedad Química y Minera de Chile SA , or SQM, increased output at their Atacama mines; output was up 8.4% for Albemarle and 50.1% for SQM year over year, and labor costs decreased 2.5% for Albemarle and 14.4% for SQM. Both companies reported higher employee headcount in 2021 compared with year-end 2020, although larger economies of scale meant unit labor costs actually decreased.

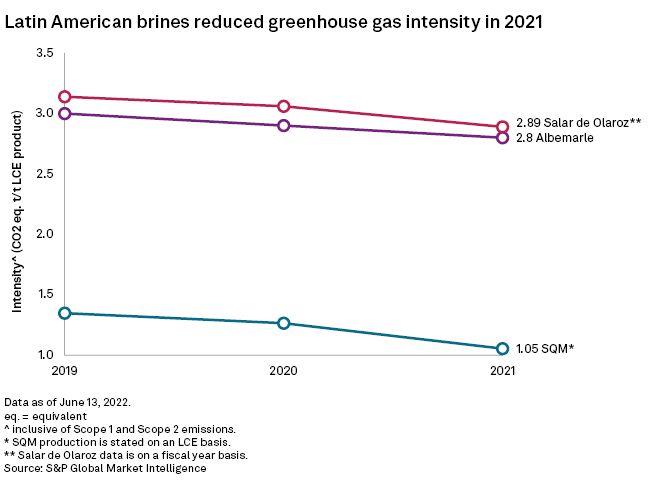

Energy costs increased slightly, partly due to a rally in oil prices with the ICE Brent Crude Index up 50.1% in 2021, but the higher energy costs accounted for less than 1% of lithium total cash costs. Mining companies' efforts on the energy transition and the path to net-zero — more renewables and improved energy efficiency — along with greater economies of scale have helped neutralize rising fuel costs. Albemarle said its renewable energy penetration rates from primary sources increased to 3.2% in 2021 from 1.7% in 2020. In the lithium segment, greenhouse gas emissions intensity fell to 2.8 tonnes of CO2 equivalent per tonne of LCE product from 2.9 tonnes CO2e/t LCE in the previous year. SQM also reported a downward trend. Intensities of its lithium carbonate and hydroxide products, including Scope 1 and Scope 2 emissions, declined 14.3% and 10.6% year over year, respectively, in 2021. SQM's nonrenewable fuel consumption in 2021 was almost flat compared with the 2020 level, despite its lithium derivative production rising 36,000 tonnes LCE. In Australia, Mineral Resources Ltd. said in its latest sustainability report that it is actively reducing its reliance on diesel fuel.

Price inflation for raw materials has pushed up reagent and other on-site costs. Lithium concentrate-producing hard-rock mines are not very sensitive to increases in reagent prices because of the limited reagent consumption involved in the flotation or dense media separation processes. But rising costs for other raw materials could be a critical factor driving up other on-site and sustaining capital costs. Based on U.S. Geological Survey estimated data, the average price of ammonia, a material used to produce explosives, increased 128.7% in 2021. Market Intelligence data shows concentrate producers' other on-site costs increased $206/t LCE in the same year. The price of sulfur, which is used to produce sulfuric acid, an important reagent for the brine recovery process, rose about 300% in 2021. Reagent costs of lithium chemical producers rose $174/t LCE in the same year.

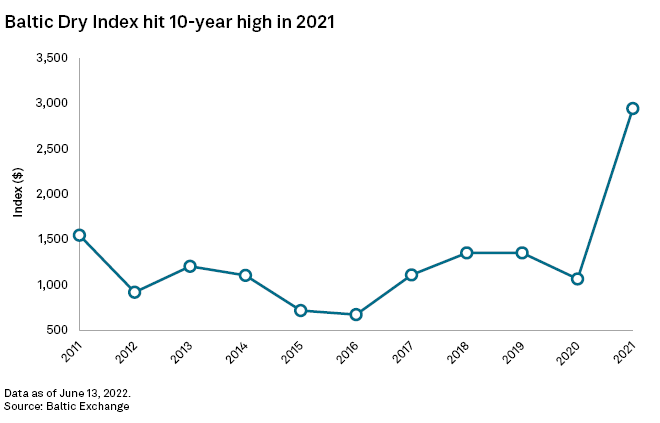

Lithium producers' shipment and royalty costs also increased year over year, mainly due to supply chain challenges and growth in lithium product prices. Supply chain constraints have pushed up freight expenses. When supply disruptions peaked in September 2021, the Baltic Dry Index exceeded $5,000 for the first time since 2007. Royalties in major producing countries — including Australia, Chile and China — are calculated as a percentage of revenues, translating to higher royalty costs as prices increase.

Market Intelligence expects that lithium total cash costs will continue rising in 2022, and royalty costs will be a major contributor. S&P Global Commodity Insights forecast the lithium carbonate CIF Asia price to average $41,708/t in 2022, more than triple that of 2021. Surging prices will increase lithium concentrate producers' royalty costs at the same rate. The CORFO agreement between Chilean lithium producers and the Chilean Economic Development Agency will also lead to more royalty payments by lithium chemicals producers there. When lithium carbonate and lithium hydroxide are priced at $10,000/t and 12,000/t, the current term requires Chilean operators to pay about a 13.7% and 12.7% lease on gross revenue. This lease rate will escalate to 40% on prices above $10,000/t and $12,000/t; for example, lithium carbonate prices of $24,000/t will have a lease rate of about 29%. Under the forecast scenario, royalty costs for Chilean chemical producers will surpass $6,400t/LCE in 2022, more than the sum of all other cash cost components.

The Wodgina mine in Western Australia restarted in May, and Cauchari-Olaroz in Argentina is targeting the second half of 2022 to begin production. New and restarting projects will help ease market tightness, and a price correction is expected in the second half and into 2023. Reduced prices will combine with rising costs to shrink producers' margins. We do not expect to see the industry returning to the tight margins experienced in 2019 and 2020.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.