S&P Global Commodity Insights reports on M&A activity in 2023 in the metals and mining industry with a minimum deal value of $10 million and 1 million ounces of gold or 100,000 metric tons of base metal in acquired reserves and resources (R&R). This report categorizes acquisition assets by primary metal — gold, copper, nickel and zinc — and the acquisition cost for projects that contain more than one metal is not split. Terminated, nonequity deals — such as royalty and streaming — and "earn-in" transactions are not included in the analysis, and deal status is as of the time the data was compiled.

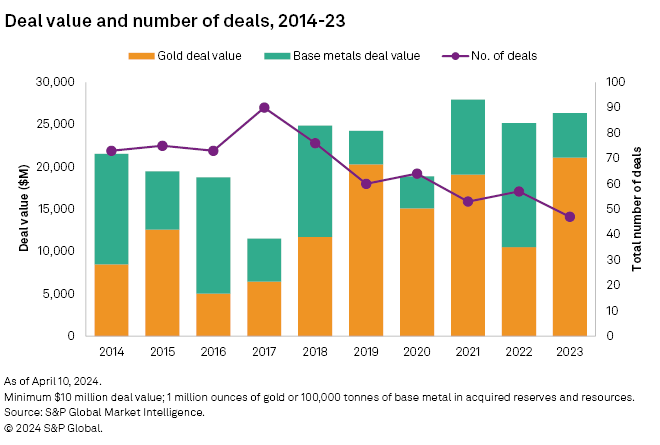

M&A activity in the metals and mining sector that fit our criteria for this study has been steady year over year, albeit skewed by the megadeal between Newmont and Newcrest. In 2023, there were 47 deals — 30 focused on gold, 14 on copper and three on nickel — for a total deal value of $26.36 billion. In total, 223 million ounces of gold in reserves and resources exchanged hands, as well as 44.1 million metric tons of copper and 1.2 MMt of nickel. Absent the Newmont-Newcrest merger, the gold metrics are more modest.

Metals and mining industry M&A activity in 2023 was steady year over year. The $26.36 billion total deal value was the second-highest in the past decade, buoyed by the megamerger between gold majors, US-based Newmont Corp. and Australia-based Newcrest Mining Ltd. in the first quarter. The deal was valued at nearly $17 billion — a record for gold-focused transactions — with a portfolio consolidation of 134.3 Moz of gold and 22.5 MMt of copper in R&R for the American mining giant. This single deal accounts for 63% of the 47 qualifying transactions' total deal value and makes up 60% of the gold in R&R purchased throughout the year. In the absence of that transaction, 2023 would have been the worst performer of the 10-year period. The copper contribution to the deal is not taken into account in the copper total as it was not the focus of the deal; in terms of R&R acquired, however, the merger would have also been the largest copper deal for the year.

While the total deal value was slightly up year over year, the number of deals meeting our criteria fell to 47 from 57 in 2022. This makes for the highest average deal value since 2013, also skewed by the Newmont-Newcrest merger. There were 30 gold deals — just one more than in 2022 — but the total deal value for the commodity was double, and 223.4 Moz of the yellow metal were purchased. All metrics were down for copper-focused transactions: The number of deals fell 22% to 14, with a lower amount of metal in R&R, while the total deal amount plummeted 67%. On the other hand, the number of nickel deals was flat year over year, but the total deal value more than tripled for less metal bought. The price paid per metric ton of metal acquired was at a premium compared with 2022, up over 600%, especially given that the average annual market price was down by nearly half. There were no zinc deals.

One deal of note that was not included in our list as it does not meet the $10 million minimum is the completed transaction between private investor Ross Beaty and the Canada-based junior Lumina Gold Corp., in which more than 5 Moz of gold in R&R were purchased. The deal does not have a price tag as it stems from the conversion of Ross Beaty credit facility to common shares, which brought up the investor's stake in Lumina and its flagship Cangrejos gold-copper project to 27.7%. The transaction is important, however, given that Cangrejos is the largest primary gold deposit in Ecuador, with the recently completed prefeasibility study identifying 20.5 Moz of the yellow metal in R&R.

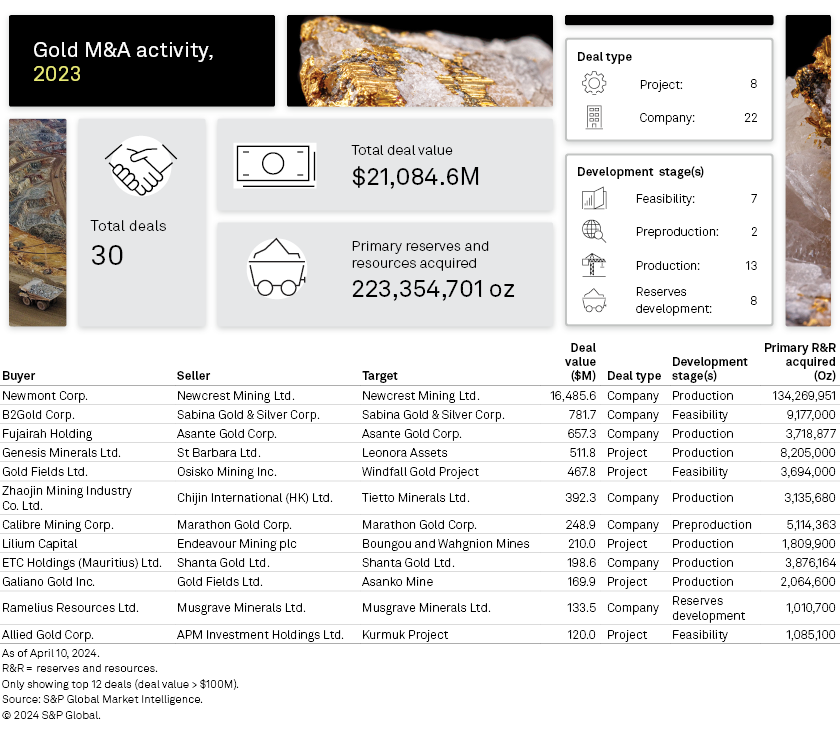

Gold – the unsurprising outperformer

Given the head start imparted by the Newmont-Newcrest merger, it was no surprise that gold would shine in the M&A landscape. Adding to the luster was the strength of the gold price, which averaged above $2,000 per ounce for the year, sustained by the commodity's safe-haven nature as macroeconomics and geopolitics rocked markets. Stripped of this megadeal, the list of gold-focused transactions is more modest, however, with the overall amount coming in below $5 billion and the gold in R&R purchased just shy of 90 Moz.

In fact, the second-largest gold deal in value is the fourth overall, behind two copper deals, and with less than 10 Moz of gold in R&R, it is also the second largest by this metric. In its completed purchase of fellow Canada-based explorer Sabina Gold & Silver Corp. for $781.7 million, major B2Gold Corp. acquired the fully permitted Goose gold project in Nunavut and its 9.2 Moz of gold in R&R; the mine is currently under construction, with commissioning planned for 2025.

The highest price per ounce of gold acquired was offered in the unsolicited and yet-to-be-finalized bid by Fujairah Holding LLC to acquire all of Asante Gold Corp.'s issued and outstanding common shares that it does not hold. Should Asante accept the offer, Fujairah would hold all of Asante's Ghanaian assets, including the Chirano and Bibiani mines, which host most of the gold in R&R estimated in the transaction. Despite the offer being deemed a too-low price per share by Asante's board, it would amount to $177/oz of gold acquired in R&R, higher than the $123/oz that Newmont paid for Newcrest's metal. The lowest offer is a mere $49/oz in Calibre Mining Corp.'s acquisition of Marathon Gold Corp. in exchange for three mines, one of which, located in Canada, is in construction with a projected start date of 2025 and 5.1 Moz of gold in R&R.

Of the 30 gold transactions, 22 were company takeovers, with nine of those being producing operations. Moreover, half of the asset transactions involved a producing mine. The buyers were somewhat evenly distributed, consisting of nine major miners, nine junior miners, six intermediate companies and six deriving their revenues from other sources.

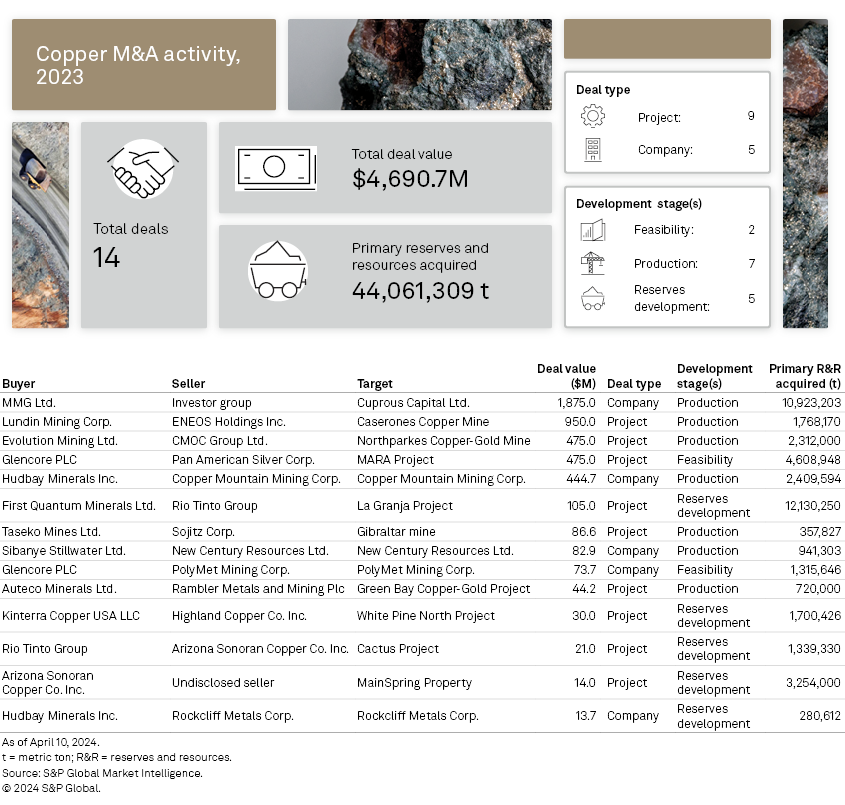

Copper – the simmering pot

Much fewer in number than gold transactions, the 14 copper deals garnered a total of $4.69 billion; this compares with what would have been a lackluster second place for gold with a revised total of $4.60 billion without the Newcrest-Newmont deal. Over the past few years, copper transactions increased in tandem with the red metal's perceived value, likely driven by the criticality of the metal to the green energy transition paired with its looming deficit. Despite exploration budgets being at a high, most of the allocations for copper are spent on and around mine sites rather than on brownfield projects that could start to address the scarcity of the commodity. M&A has therefore come to the fore as a means for companies to consolidate their copper portfolio and strategically position themselves to benefit from the forecast increase in demand and prices.

The majors accounted for 10 transactions and spent the most money as well — 96% of the total copper deal value, and coincidently for 96% of the copper in R&R that changed hands. The lion's share of that spend was directed to producing assets, emphasizing the quest for a quick return on investment as the copper market price will likely be boosted by the concentrate market deficit deepening further through to 2026.

That said, the average annual market price came down from the 2021 high, as did the price paid per metric ton of metal acquired in R&R, coming in at $0.05/lb compared with three times that amount in 2021. The copper price has rallied during the first four months of 2024 on a tightening global concentrate market due to disruptions at mines, peaking at a two-year high of $9,834/t April 19.

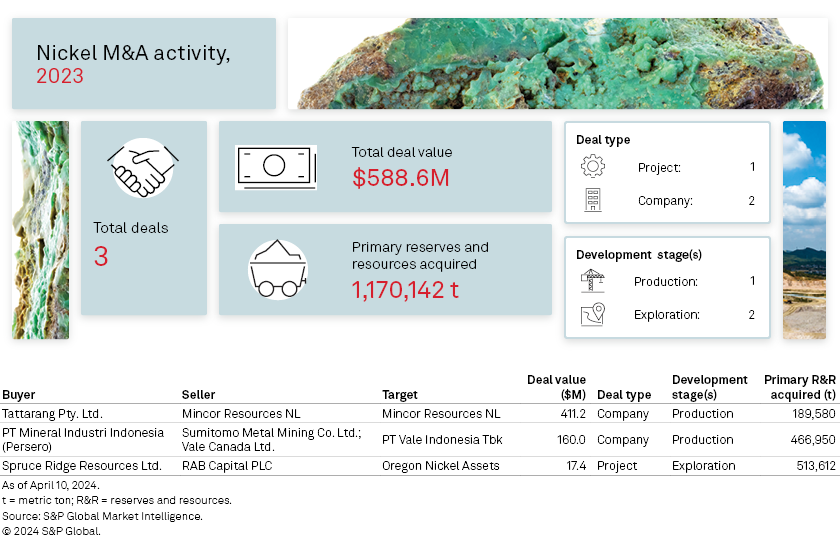

Nickel – the underdog worth watching

While nickel is not in the same league as gold or copper in overall number of deals or amount spent, the year-over-year comparison of M&A activity is noteworthy. In both 2022 and 2023, there were just three deals; but while the average annual market price nearly halved, making nickel the worst performer of the base metals on the London Metal Exchange, the total amount spent in M&A was up 380%, and the price paid per metric ton of metal acquired in R&R shot up 615%.

Two of the transactions targeted companies, both producing, while the last deal was the acquisition of projects still in the exploration phase. The latter deal involved the most nickel in R&R, as junior miner Spruce Ridge Resources Ltd. acquired 513,612 metric tons of nickel from RAB Capital PLC, for which it paid just $0.02/lb. On the other hand, Australia-based Tattarang Pty. Ltd. paid a premium of $.098/lb to acquire Mincor Resources NL and its 10 assets in the country, most of which are operating.

The last deal valued at over $100 million is still pending, with a definitive agreement slated for late April. PT Mineral Industri Indonesia (Persero) is seeking to acquire 14% of PT Vale Indonesia Tbk and its three properties for $160 million. Indonesia is the leading primary nickel producer and is expected to drive global growth over the medium term as the energy transition unfolds. The country benefits from lower operating costs than its producing peers Australia and New Caledonia. This means that companies based in Indonesia have been able to weather the slump in nickel market prices, while others were forced to shutter those operations that have sunk into their cost curves. Two of PT Vale's properties in Indonesia have booked 2023 cash costs of $6.56/lb and $6.85/lb, respectively, according to Market Intelligence data, compared with an average market price of $7.43/lb.

Looking ahead – "critical" will be the key word

The state of the market for metals critical to the energy transition — copper, nickel — is also critical. Commodity Insights expects both markets to turn into deficit by 2028, prompting us to expect the slow but steady shift in focus on those metals in M&A to continue in 2024 and beyond. While the macroeconomic environment is challenging, with some geopolitics coming into play as well, miners will keep seeking to position themselves strategically to benefit from the inevitable rebound in metals demand and prices. Even though the high price environment can be a hindrance to M&A, it will nevertheless boost deal values. This can favor transactions that involve major companies as buyers, as they will likely have the most cash available to spare. At the time of writing, the world's largest mining group, Australia-headquartered BHP Group Ltd., has offered to take over UK-based Anglo American PLC for $25.44 billion as a means to expand its copper footprint through the acquisition of 91.2 MMt of copper in R&R.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.