The COVID-19 pandemic may have made handshakes less socially desirable, but in the utility regulatory realm, there are often clear incentives for utilities and entities with vested interests in the sector to embrace compromise. Utilities often obtain settlement benefits in the form of key utility policy objectives and more favorable rate case outcomes than would otherwise be achievable.

* Settlements are used extensively in electric and natural gas utility base rate proceedings and can be an appealing way for the utilities and the major participants in these cases to bridge the differences between their respective positions.

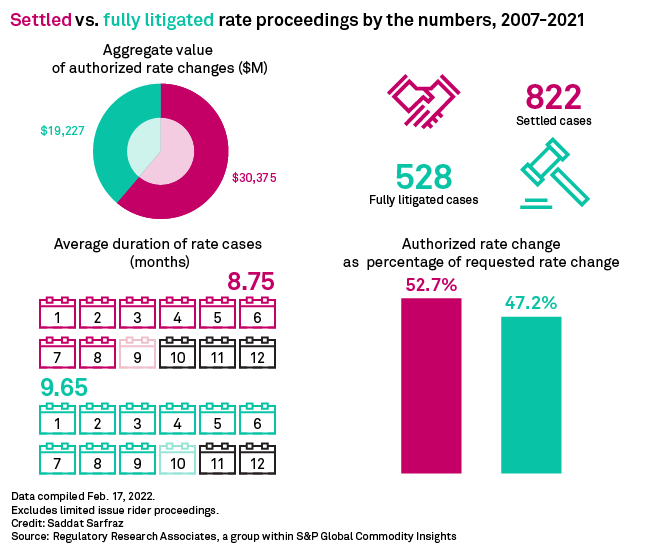

* In the years 2007 through 2021, Regulatory Research Associates followed 1,350 electric and gas utility base rate cases. Of these proceedings, the 822 deemed to be "settled" gave rise to more than $30 billion in rate increases. An additional 528 cases were considered "fully litigated" and resulted in about $19 billion in approved rate hikes.

* In the settled cases, the approved rate changes, in total, represented nearly 53% of the aggregate increases sought or supported by the utilities. In the fully litigated cases, the authorized rate changes amounted to about 47% of the increases put forth by the companies.

As RRA points out in "The rate case process: a conduit to enlightenment," the regulatory compact calls for utilities to provide safe, reliable and reasonably priced service, the commission to provide utilities with a reasonable opportunity to recover their costs and earn a return commensurate with that of other investments with similar risk characteristics, the customers to pay the approved rates and the investors to supply the capital necessary to maintain or expand the utilities' systems.

At some point during a rate proceeding, after the intervenors have had a chance to digest the company's application, they will file their direct testimony, in which they outline their recommendations on the proposals put forth by the company. The parties will critique nearly every aspect of the utility's request, with the recommendations tailored to suit the needs of the relevant constituent group.

Usually, the commission's staff, a state attorney general and/or another state agency represent the public interest, primarily as it relates to residential customers, and their stance on rate case matters tends to be very different from that of the company. Of course, every jurisdiction is different, but intervening entities can also include an individual large commercial or industrial customer or a consortium of such customers that may have a rather limited focus; a municipality in which the utility operates; a group seeking to advance an environmental agenda; and/or an organization that advocates for the needs of a particular segment of the population, such as retired ratepayers.

After this initial round of testimony, more testimony is filed in which the parties address their concerns with the positions taken in earlier rounds. Sometimes the parties will hold firm on their positions, but more often than not, they will begin settlement discussions to see whether they can arrive at a middle-of-the-road position on some or all of the outstanding issues in the proceeding. At the very least, this will narrow the gap between the parties' respective revenue requirement positions.

If a consensus is reached regarding a stipulated rate change, then the parties — at least some of them — will sign a settlement and file it with the commission. A settlement will generally shorten the time frame required to complete a rate case, since some of the other steps in the process can be eliminated. However, if the parties are unable to reach a comprehensive agreement on the outstanding issues, the case will proceed on a litigated track, and the commission will need to rely on the evidence in the case as it develops a final decision on the issues.

Many rate cases each year are resolved by "black-box" settlements, which are filed when the parties are able to settle all, or nearly all, of their differences in the proceeding, but none of the parties wants to disclose the final outcome on a given issue because they want to avoid establishing a precedent. Or during settlement discussions each party may have contemplated a certain revenue change amount as acceptable and may have performed calculations regarding the rate base and rate-of-return parameters behind their revenue requirement positions. However, different values for these parameters could be used in varying combinations to determine the same revenue requirement.

Since a black-box settlement does not specify a rate base value or rate-of-return parameters, if the commission adopts the settlement, these figures will not be specified in the final order. The utility's authorized rate base and rate of return will still be the values that were most recently approved by the commission, even if those values are from several years ago. The utility has undoubtedly been investing in its system since the prior case, but if a rate base value has not been specified and approved during the subsequent time frame, the value from the previous case will still be the utility's "authorized rate base," despite possibly being somewhat dated. In such circumstances, RRA's rate case database will display "NA" for these variables for this particular utility.

The numbers are revealing

In the years 2007 through 2021, RRA tracked 1,350 electric and gas utility base rate cases across the U.S. Of these proceedings, 822 were deemed to be "settled" — indicating that issues accounting for the bulk of the revenue requirements in these cases were ultimately settled — and gave rise to more than $30 billion of rate increases. An additional 528 cases during this time period were considered "fully litigated" and resulted in about $19 billion of approved rate hikes.

In the settled proceedings, the approved rate changes, in aggregate, represented nearly 53% of the total increases sought or supported by the utilities. In the fully litigated cases, the ultimately authorized rate adjustments came to only about 47% of the aggregate amount of the rate changes put forth by the companies.

There is ample room for compromise

Although black-box settlements are often used to resolve all outstanding matters in rate cases, settlements can also be focused on a narrow set of issues. Partial settlements can be used to reduce the number of issues that need to be discussed at a hearing and ultimately decided by the commission. These agreements can deal exclusively with issues such as rate of return and capital structure; the amortization period to be used to recover a regulatory asset balance over time; or rate design techniques that will be used to allocate the approved rate change to each customer class. Partial settlements can address nearly all outstanding differences between the parties, leaving only a few minor issues for adjudication.

For example, in a pending base rate proceeding for Portland General Electric Co., the parties have tendered four partial settlements as they have sought to work through many of the outstanding issues in the case. Several issues remain unresolved and will continue to be litigated, including various deferrals, the company's wildfire mitigation effort and vegetation management mechanism, and certain rate design provisions. With many issues off the table, the company now supports a rate increase that is meaningfully lower than the rate hike sought at the beginning of the case.

One of the most frequently settled issues in a rate case is return on equity. The parties to a settlement recognize that the determination of an ROE is quite subjective, and by finding a middle ground on this issue, the gap between the parties' respective positions can be narrowed considerably. As RRA has shown, the average authorized ROEs can vary greatly for rate cases that were resolved through settlements and those that were fully litigated.

In 2021, the average ROE adopted across all electric rate cases followed by RRA was 9.38%. In the 25 settled proceedings in which an equity return was specified, the average authorized ROE was 9.57%, while in the 29 fully litigated cases in which an ROE was identified, the average was 9.22%, suggesting that utilities can benefit from working to resolve this issue.

On the gas side of the business, the average approved ROE in 2021 was 9.56%. In the 29 settled cases in which the parties agreed to an ROE, the average authorized equity return was 9.52%, while in the 13 fully litigated cases that gave rise to an ROE authorization, the average was 9.63%, indicating that the average was likely skewed by outlier return figures.

Rate of return differences may account for a meaningful portion of a utility's rate change request and drive the desire for the parties to settle this issue, but other matters in a rate case that do not directly impact the base revenue requirement can become a focal point of settlement discussions. For example, an adjustment clause may have been sought to flow to ratepayers variations in a particular aspect of the utility's cost profile. Resolving this issue in a constructive manner through a settlement can be beneficial to the parties — the utility can gain a degree of regulatory certainty regarding a highly variable cost item, and the intervenors can use the leverage they have gained through negotiations to obtain a resolution on another issue of importance to them.

For example, Duke Energy Corp. subsidiary Duke Energy Kentucky Inc. recently received approval of a settlement from the Kentucky Public Service Commission to amend its gas distribution base rates and establish a pipeline modernization rider for costs associated with projects necessitated by pipeline integrity regulations promulgated by the U.S. Department of Transportation's Pipeline and Hazardous Materials Safety Administration. The stipulated rider provisions were slightly less advantageous to the company than those it had initially put forth — the rider is to remain in place for a seven-year period, a revenue requirement cap is to apply and an ROE below that used to set the company's base revenue requirement is to apply to rate adjustments under the rider.

Settlements reached in the context of rate proceedings can also provide support for important utility structural changes, rate design approaches and broad policy initiatives. For instance, in a recently concluded case, an adopted settlement provides for customers of NextEra Energy Inc. subsidiary Gulf Power Co. to become customers of affiliate Florida Power & Light Co. and be subject to similar rate design provisions. The settlement approved by the Florida Public Service Commission also supports the companies' plans to bolster solar generation capacity, permits the use of a storm cost recovery mechanism, and authorizes the creation of several electric vehicle pilot programs.

A settlement can be an efficient way to bring a rate case to its conclusion, but since the evidentiary record regarding a stipulated issue may be rather thin and the commission has not had to weigh in on the merits of that issue on a stand-alone basis, the settlement is typically not used to establish a precedent that can be relied on in a future proceeding. Just because a party has signed on to a settlement that treats an issue in a given manner in one case does not mean they are bound to the same position in future cases.

Settlements serve a role in protecting the public interest

Utility regulatory settlements typically must satisfy some sort of public interest standard. For example, the Minnesota Public Utilities Commission has said that it "must apply a different standard than is normally used by the courts. Unlike the traditional function of civil courts, the commission's primary function is not to resolve disputes between litigants. Instead, it is an affirmative duty to protect the public interest by ensuring just and reasonable rates." This is generally a consistent theme among utility commissions.

"Unlike the traditional function of civil courts, the commission's primary function is not to resolve disputes between litigants. Instead, it is an affirmative duty to protect the public interest by ensuring just and reasonable rates." — Minnesota Public Utilities Commission in Docket No. G-008/GR-19-524

The Indiana Utility Regulatory Commission views settlements in a similar manner. As it recently highlighted in a rate case order for American Electric Power Co. Inc. subsidiary Indiana Michigan Power Co., "[S]ettlements presented to the commission are not ordinary contracts between private parties. ... When the commission approves a settlement, that settlement 'loses its status as a strictly private contract and takes on a public interest gloss.' ... Thus, the commission 'may not accept a settlement merely because the private parties are satisfied; rather [the commission] must consider whether the public interest will be served by accepting the settlement.'"

"When the commission approves a settlement, that settlement 'loses its status as a strictly private contract and takes on a public interest gloss.' ... Thus, the commission 'may not accept a settlement merely because the private parties are satisfied; rather [the commission] must consider whether the public interest will be served by accepting the settlement.'" — Indiana Utility Regulatory Commission in Cause No. 45576

Some jurisdictions are more likely to agree to disagree

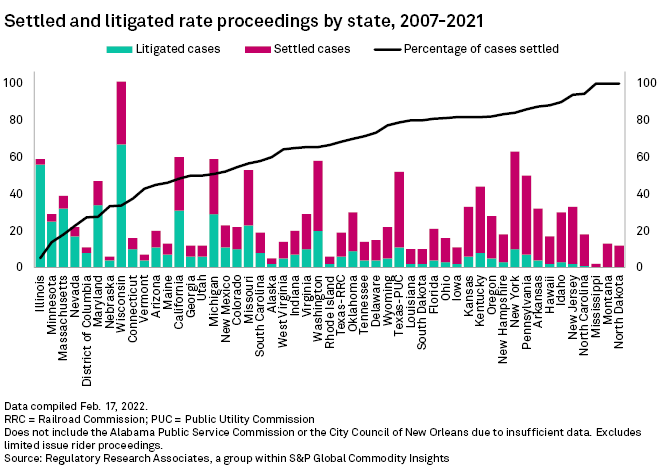

Some jurisdictions rely more heavily on the use of rate case settlements than others. A jurisdiction in which utility matters are heavily politicized may have intervenors that are less willing to find a middle ground that could balance the interests of ratepayers and utility shareholders. A prominent intervenor like a consumer advocate or attorney general may have an axe to grind with the utility because of a past disagreement, or that individual may be attempting to gain name recognition to bolster their chances of being elected to a higher office in the future.

In New Jersey, most large electric and gas utility base rate proceedings to come before the New Jersey Board of Public Utilities since 2007 have been resolved through settlements. In Illinois, however, the large electric utilities regulated by the Illinois Commerce Commission are subject to the terms of a formulaic ratemaking approach that is more routine and less controversial than the traditional rate case model. In these cases, the ROE is calculated based on prevailing U.S. Treasury Bond yields, narrowing the potential issues the parties can disagree over. As such, comparatively fewer cases have been settled in Illinois since 2007.

"The presence of professional expert witnesses and attorneys helps ensure that any unreasonable position(s) taken by any party are eliminated by opposing parties through the settlement process. More specifically, while an unreasonable position(s) may or may not be discussed explicitly in settlement, each party is generally unwilling to make concessions to unreasonable position(s) and will exclude such unreasonable position(s) from their respective settlement positions." — Kansas Corporation Commission staff in Docket No. 21-BHCG-418-RTS

The Kansas Corporation Commission, or KCC, which has seen the settlement of more than 80% of the major electric and gas utility base rate cases that have come before it since 2007, has an established policy of supporting compromise and the settlement of disputes in cases "when the agreement is entered into intelligently and in good faith." When presented with a unanimous settlement, the KCC relies on a "three-factor test" in which the commission must determine whether the settlement is supported by "substantial competent evidence" in the record as a whole; will establish "just and reasonable" rates; and is in the public interest.

The Public Service Commission of New York has a long track record of adopting settlements that include multifaceted, multiyear rate plans. Most of the major utilities in the state are subject to plans that include earnings-sharing provisions and the potential for penalties to be imposed if service quality and customer service concerns arise. These plans also generally include expense reconciliation mechanisms that allow the utilities to defer increases in some expenses under certain conditions. These provisions are the product of give-and-take negotiations that took place under the state's regulatory model.

In a recent rate order for CH Energy Group Inc. subsidiary Central Hudson Gas & Electric Corp., the PSC made clear that the benefits of the settlement process can inure to all parties. The PSC said: "[C]omprehensive settlements of utility rate proceedings can require more time and resources than litigated proceedings, but ... three-year rate plans may offer benefits that offset the commitment of resources, including increased revenue certainty and the ability to focus on operating as efficiently as possible for the utility and, for customers, increased rate certainty."

The PSC concluded that the settlement "reflects compromises made by diverse and ordinarily adversarial parties with strong incentives to craft resolutions that addressed their various interests. It is a proposal that could reasonably be expected to result from litigation; nevertheless, as a rate plan developed by so many parties with specialized knowledge, we conclude that it is likely superior to the probable outcome of adversarial litigation."

The settlement process can be effective at eliminating extreme positions that could otherwise be presented to the commission. As the KCC staff noted in settlement testimony in a 2021 rate case for Black Hills Corp. subsidiary Black Hills Kansas Gas Utility Co LLC, "The presence of professional expert witnesses and attorneys helps ensure that any unreasonable position(s) taken by any party are eliminated by opposing parties through the settlement process. More specifically, while an unreasonable position(s) may or may not be discussed explicitly in settlement, each party is generally unwilling to make concessions to unreasonable position(s) and will exclude such unreasonable position(s) from their respective settlement positions."

"[C]omprehensive settlements of utility rate proceedings can require more time and resources than litigated proceedings, but [they may produce] benefits that offset the commitment of resources, including increased revenue certainty and the ability to focus on operating as efficiently as possible for the utility and, for customers, increased rate certainty." — Public Service Commission of New York in Case Nos. 20-E-0428 and 20-G-0429.

Despite the best intentions of the stipulating parties, settlements are not always adopted in their entirety. Since 2007, more than 80% of the large utility rate cases to come before the Kentucky PSC were settled. However, the PSC adopted modifications to settlements over the past two years for NiSource Inc. subsidiary Columbia Gas of Kentucky Inc., Duke Energy Kentucky, Essential Utilities Inc. subsidiary Delta Natural Gas Co. Inc. and PPL Corp. subsidiaries Louisville Gas and Electric Co. and Kentucky Utilities Co. The modifications were largely related to ROE and certain rider provisions.

Occasionally, a settlement may not draw the interest of all the parties to a rate case. One or two parties may not agree with the way an issue was addressed in the settlement and can choose to formally object to the agreement. In these situations, the commission will consider the parties' objections as it evaluates the overall case record. In Missouri, a non-unanimous settlement is treated by the Missouri Public Service Commission as the joint position statement of the stipulating parties, and all outstanding matters, including those discussed in the settlement, are evaluated on their merits at a hearing.

Settlement discussions are often informal and proceed smoothly. In some circumstances, these discussions can fail to produce the desired result, even when an independent entity is overseeing the process. For example, the mediator conducting settlement negotiations in Sun Jupiter Holdings LLC subsidiary El Paso Electric Company's pending rate case recently announced that negotiations were unsuccessful, and the case was returned to the Public Utility Commission of Texas' administrative law judges for the next step. It is unclear whether the parties will continue to negotiate outside of mediation, or whether a litigated track will immediately resume.

Use of settlements not confined to rate case arena

The use of settlements is not restricted to rate cases. Other types of matters before the state utility commissions can also be ripe for settlements. Their use is prevalent in merger review proceedings, with numerous deals having reached their finish lines thanks to parties' efforts to reach a consensus on post-closing ratepayer concessions.

For example, the 2018 merger of Great Plains Energy and Westar Energy that led to the formation of Evergy Inc. was approved by the Kansas and Missouri commissions following settlements that gave rise to customer bill credits, base rate moratoriums and certain employee retention requirements.

If a commission is not satisfied with the terms of a settlement, it may reject it. This could prompt the parties to amend the stipulated terms and present a revised agreement to the commission. This occurred in 2020 with ENMAX Corp.'s purchase of Versant Power, then known as Emera Maine, from Emera Inc. The Maine Public Utilities Commission rejected a settlement over concerns that the agreement failed to meet the "net benefits" standard outlined in state law. The PUC ultimately adopted a revised proposal and the transaction was completed shortly thereafter.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.