This analysis is written and published by S&P Global Market Intelligence; a division independent of S&P Global Ratings, and references in this analysis to “we”, “us” and “our” refer to S&P Global Market Intelligence. In this article we explore possible credit contagion effects from the corporate sector to real estate by using S&P Global Ratings’ research and underlying data to formulate your own views on risks in the sector. This research below is differentiated from the credit opinions published by S&P Global Ratings.

A Tale of Two Real Estate Defaults

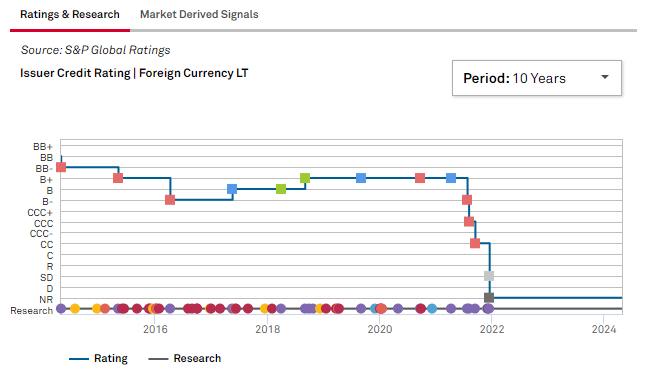

In July 2021, S&P Global Ratings downgraded the credit ratings for China Evergrande which eventually went into selective default. China Evergrande’s demise followed the familiar pattern of real estate cycle corrections with an outsized impact on developers aggressively expanding on the back of cheap credit. The credit rating of B- in the year 2016 provided market participants insight into possible default. (See chart A).

In contrast, Washington Prime Group had a BBB- and above credit ratings up until 2019 when COVID-19 started to cause distress in the retail segment, especially in Department Stores. S&P Global Ratings research analysts began to flag in year 2018 that Washington Prime’s “mid-tier quality mall assets will continue to experience deteriorating operating metrics”. Weaknesses in the Company’s corporate customers coupled with the unexpected outside factor of COVID-19 that accelerated tenant distress, bankruptcies, and store closures eventually dragged this REIT (Real Estate Investment Trust) into default.

Chart A: S&P Global Ratings Issuer Credit Rating trends China Evergrande (left chart) and Washington Prime Group Inc. (right chart)

Source: RatingsDirect® on S&P Capital IQ Pro, as of April 2024. For Illustration Only.

Note: Foreign Currency LT indicates that the credit rating is a Foreign Currency Long-Term rating

Ratings Distribution and Outlook for Real Estate looks Benign, but the forward-looking credit perspective is murky.

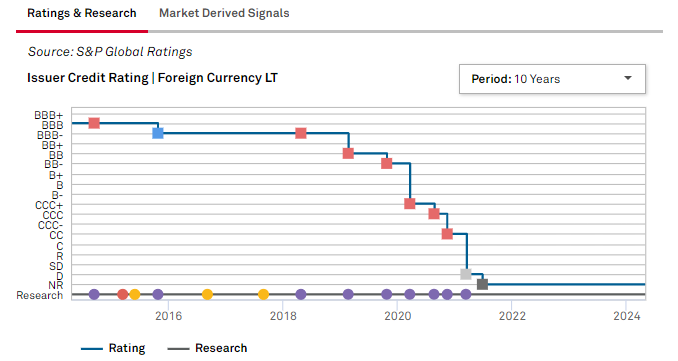

S&P Global Ratings currently rates 74% of real estate entities in investment grade - at “BBB- and above”. The credit ratings outlook is currently anchored around “Stable” for this sector, however with a negative bias of companies with “Outlook Negative” at 15.6%, exceeding “Outlook Positive” by a ratio of 2.4:1 (Chart B)

Chart B: Credit Ratings outlook distribution of real estate entities

Source: RatingsDirect® on S&P Capital IQ Pro, as of April 2024. For Illustration Only.

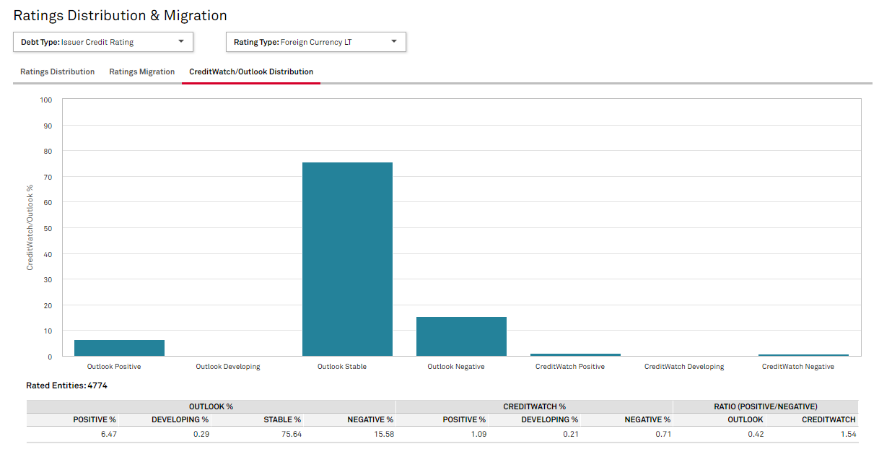

We are interested in the market perspective and use CDS indicators to compute an “upgrades vs. downgrades” measure comparable to the above. We map the CDS spreads to a lowercase score from (“aaa” to “d”) and compare that to the credit rating. When more (fewer) entities are mapped higher vs. lower than the credit rating and hence the percentage is positive (negative), it may be a signal for ratings upgrades (downgrades) in the sector. You can see that this volatility adjusted measure was mostly negative, with a most recent reading of -13.0%, as the recent slate of news on defaults dampened sentiment. This is in stark contrast with the full sample of corporates where the same metric is mostly neutral with the most recent reading at -1.7%, with some signs of COVID-19 pandemic recovery in 2021 (Chart C).

Chart C: % Rating Upgrades minus Downgrades implied by CDS spreads for real estate only vs. Corporates, 2018 to April 2024

Source Data from on RatingsDirect® on S&P Capital IQ Pro® from S&P Global Market Intelligence, as of April 2024. For illustration only.

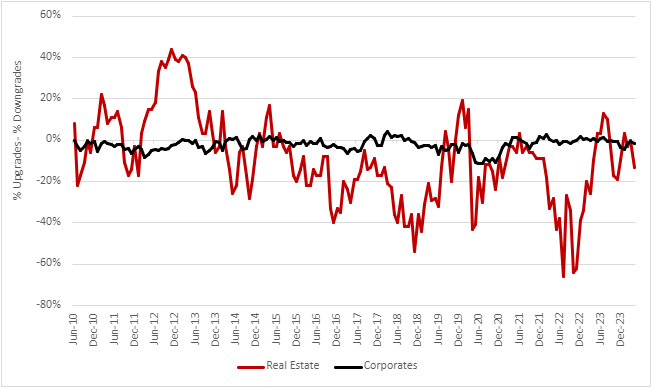

Identifying the impact of spillovers from Corporates to Real Estate

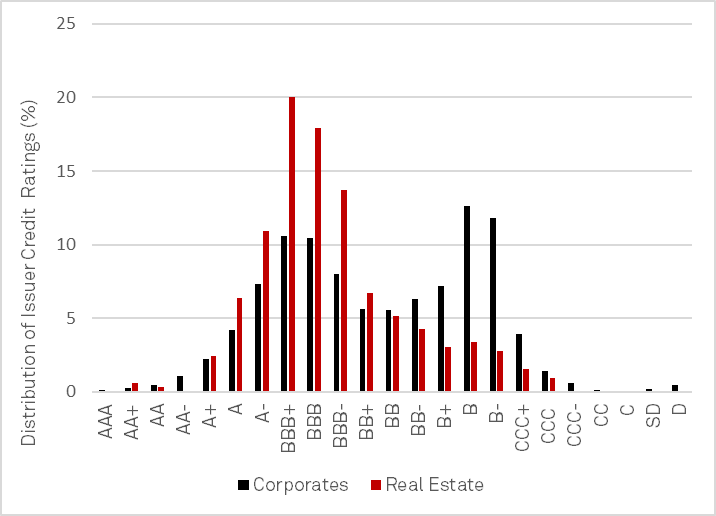

A key concern is the secondary effects of worsening credit health of the corporate sector, which can spill over to real estate in the form of non-payment of corporate leases. When we look at the credit ratings distribution of corporate entities, we are seeing a peak in the “B to B- “range, with 18% of these entities[CM1] [NS2] rated B- and below at elevated risk of delays or non-payment on their obligations[CM3] [NS4] .

Chart D: S&P Global Ratings Distribution for Real Estate vs. Corporates

Source: RatingsDirect® on S&P Capital IQ Pro from S&P Global Market Intelligence, as of April 2024. For Illustration Only.

Weak Cash flow to Leverage for Corporates on the back of elevated interest rates

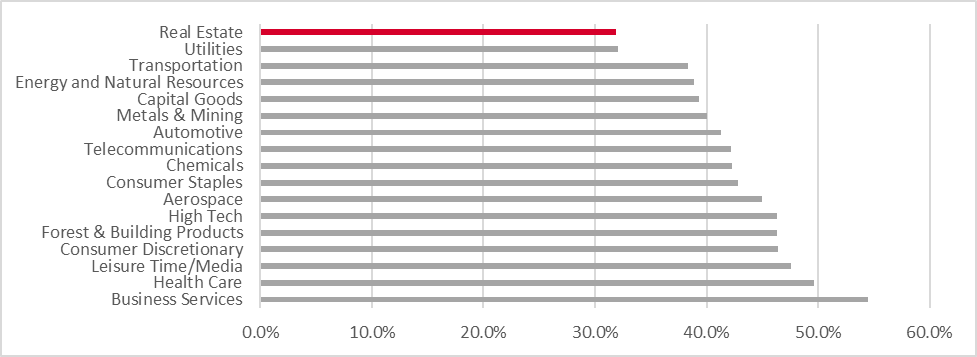

Looking at the S&P Global Ratings scores for cash flow to leverage for Corporates, we note that 23.5% are in the worst two categories on a scale from 1 to 6. Notably, both consumer-oriented industries ( Automotives, Consumer Services, Consumer Products, and Packaging, Leisure Time/Media) and sectors supporting industries (Business Services, Capital Goods, High Tech, Forest & Building Products) having over 40% of entities in the lowest two buckets. (Chart E)

Chart E. Percentage of entities with Cash Flow/ Leverage Scores = “5 (Aggressive)” or “6 (Highly Leveraged)” within industry[CM5]

Source: RatingsXpress® Scores and Factors database from S&P Global Market Intelligence, as of April 2024. The underlying scores data is also available in RatingsDirect® in S&P Capital IQ Pro. For Illustration Only.

Conclusion: Implications on risk surveillance on real estate

The current investment grade credit rating of a real estate entity can be seen as a positive sign that it has at least an adequate capacity to meet its financial commitments (source: S&P Global Ratings’ Definitions[CM6] ). Negative outlooks, particularly when both from a fundamental and market perspective and poor financial risk scores may indicate early warnings of deterioration or default. Additionally, continued credit risk surveillance on the real estate company’s corporate tenants can uncover hidden risks - especially in cases where the real estate entity has concentration risks in industries or geographies with elevated leverage. Finally, having the right information is critical. Keeping tabs on the analysts’ research updates and context/change in tone in their research reports could provide insights into credit health declines of a specific real estate entity and help formulate downside scenarios in default risk.