Introduction

Significant macro threats could present challenges to the U.S. life insurance industry's top and bottom lines during the second half of 2022.

At the same time prospects for the U.S. economy to enter a recession continue to increase, S&P Global Market Intelligence's newly released U.S. Life Insurance and Annuity Market Report projects that death benefits paid on life insurance policies will remain elevated in 2022 due to COVID-19-related mortality.

Economic weakness could accelerate the downward pressure on both the number of individual life insurance policies insurers are issuing and the amount of premium group life providers are collecting in the face of already challenging year-over-year comparisons. It might also slow the momentum that rising interest rates have produced in the individual annuity business.

The report projects a decline in the ratios of death benefits to premiums in the individual and group life businesses in 2022, but the potential for high COVID-19 case counts to eventually culminate in additional mortality through the balance of the year will help determine the steepness of the downward curve. Longer-term implications directly and indirectly related to COVID-19 on morbidity and mortality remain highly uncertain, and the most significant effects may not emerge within the five-year scope of our outlook.

This time will be different

Our projection for well-above-average growth in U.S. life, annuity and accident and health direct premiums and considerations across business lines of 6.4% in 2022 is based, in part, on an IHS Markit macroeconomic forecast for modestly positive expansion in gross domestic product and continued low levels of unemployment.

Expectations for particularly strong growth in annuity sales fuel our optimism as we project they will mitigate levels of growth in the individual and group life lines that would mark sharp reductions from outsized 2021 output. Subsequent to the issuance of our report, LIMRA's Secure Retirement Institute announced that annuity sales on a preliminary basis climbed by 14% year over year in the second quarter and 9% for the first half of 2022.

A weaker economic environment could make it tougher for the industry to grow the life business relative to 2021 results that were characterized by outsized expansion in individual universal life sales, benefits from full employment on group life premium volumes and a sharp increase in purchases of bank-owned life insurance. This assumes the combination of soaring consumer prices and a presumed rise in unemployment would limit some individuals' capacity to purchase or maintain coverage while also placing downward pressure on policies offered through the worksite. While our report focuses on premiums and expenses, a recession would also carry material implications for insurers' investment portfolios.

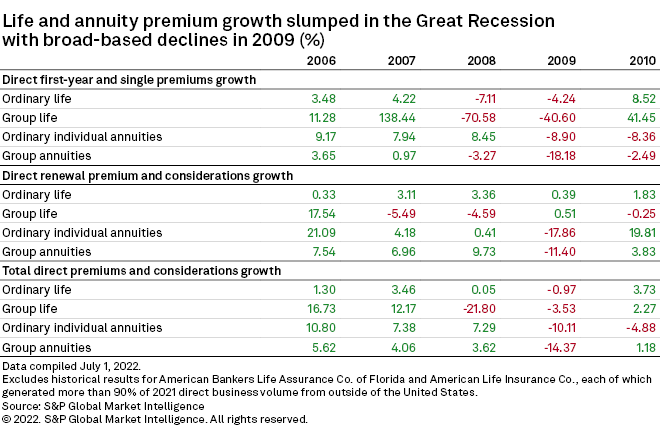

Concerns about an economic pullback have led to a reexamination of industry premium growth trends during the Great Recession of 2008 and 2009.

Direct premiums and considerations across business lines tumbled by 5.6% in 2009, including a drop of nearly 10.4% in first-year premiums and single premiums.

In the ordinary life business, direct premiums increased by less than 0.1% in 2008, then declined by nearly 1% in 2009. The ordinary individual annuity business showed growth in direct premiums and considerations of 7.3% in 2008, but they then tumbled by 10.1% and 4.9% in 2009 and 2010.

The group life business was especially hard hit, with direct premiums tumbling by 21.8% in 2008, then falling by another 3.5% in 2009. This decline had been exaggerated by the surge in group life premiums in 2006 and 2007 that resulted from a provision of the Pension Protection Act of 2006 that facilitated heightened issuance of private-placement life insurance to corporations.

Policies lost to lapses represent another measure we would expect to move higher in the event of a recession.

Ordinary life lapses as a percentage of the number of policies and amount of insurance in force as of the prior year-end surged in 2008 to levels the industry has not since approached. The rates in 2008 were 7.1% by number of policies and 6.3% by amount of insurance; the respective 2021 rates, by contrast, were 5.2% and 3.8%.

The stickiness of basic term life coverage sold during the pandemic relative to a more typical environment would add an interesting variable to the situation and creates the potential for incrementally higher lapse rates in a downturn.

But even while we would brace for a pullback in premium growth in the event of a downturn, it might take a particularly severe set of economic circumstances to create a reprisal of the top-line volatility that befell the industry at the time of the Great Recession.

In addition, there are several structural factors that may stave off the sort of balance sheet risk the industry encountered 14 years ago. Sharply deteriorating asset valuations and aggressive Federal Reserve responses to an emerging financial crisis led a number of industry participants to take extraordinary actions to attempt to shore up their financial standing.

Conservative approaches to product design and pricing through most of the past dozen years by the leading market participants all but eliminate the risks associated with the rich annuitant guarantees that had been relatively common in the marketplace in the mid-2000s. Increasingly robust use of reinsurance of legacy in-force blocks of business also serves to reduce risk.

Variability in new variants

Just when it appeared U.S. life industry death benefits had peaked, new COVID-19 variants emerged in 2021 to push the pandemic's human and financial toll even higher.

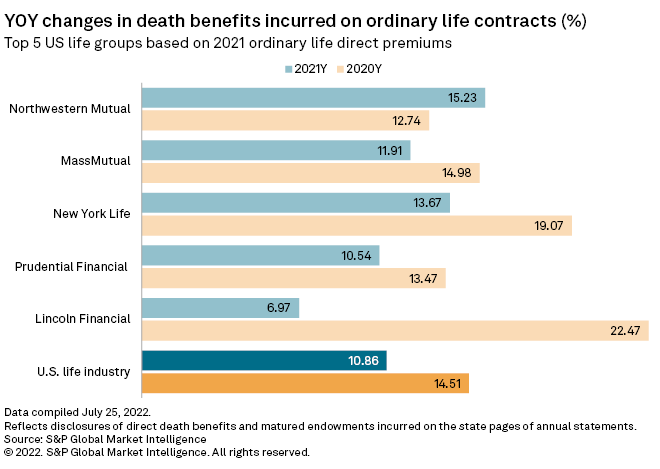

Not only did death benefits increase on an absolute basis during the year, but also the effects of adverse mortality impacted the industry differently in 2021 than in 2020.

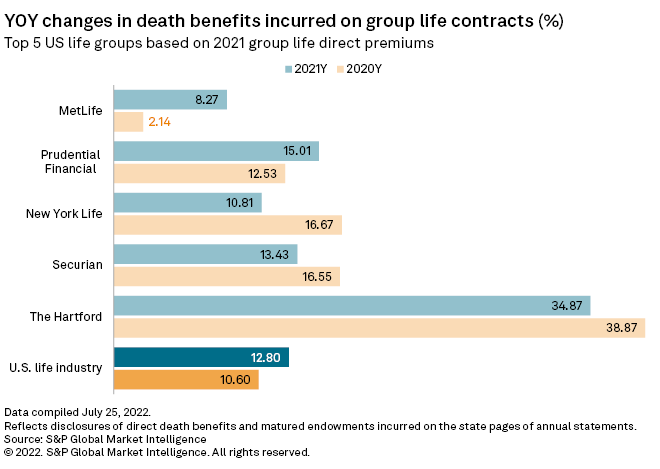

The delta variant led to a much larger share of COVID-19 deaths during the third and fourth quarters of 2021 occurring among working-age individuals than in surrounding periods. As a result, death benefits in the group life business increased to a larger extent in 2021 than in 2020 as individuals ages 18 to 64 are more likely to maintain coverage through their employer than those of retirement age.

Death benefits surged by 15.1% in the group life line on a net basis in 2021, ahead of the 11.1% growth rate in 2020. The ratio of group life death benefits to net premiums climbed to 96.5% in 2021 from 86.0% in 2020 and less than 69.4% in 2019.

Net death benefits in the ordinary life business, meanwhile, increased by 9.3% year over year in 2021 after having surged by more than 16.8% in 2020. The ratio of death benefits to net premiums in the business, however, slipped to 53.5% in 2021 from 55.6% in 2020. The pre-pandemic ratio in 2019 was 45.6%.

We project that net death benefits will fall on absolute and relative bases in both business lines in 2022. In group life, a decline of nearly 14.8% would bring death benefits to 77.7% of projected net premiums. In ordinary life, a decline of 8.5% would result in a ratio to net premiums of 51.3%. For both lines, those ratios would remain comfortably above the levels observed in the three pre-pandemic years of 2017 through 2019.

Data collected by the U.S. Centers for Disease Control and Prevention show a resurgence in COVID-19 deaths in the first quarter of 2022 as the emergence of the omicron variant took its toll, particularly among older Americans. Individuals ages 65 and above accounted for 76.7% of newly reported COVID-19 deaths on a year-to-date basis, according to data pulled July 25, as compared with a low of 58% in the third quarter of 2021 amid the virus's delta wave. This demographic trend suggests a lesser relative burden on group life insurers in 2022 than in 2021.

Public health officials have warned about the potential for future COVID-19 surges later in the year. The BA.5 omicron subvariant has triggered a rise in cases of late, with the seven-day moving average having peaked at a five-month high of 129,582 on July 16.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.