Introduction

While the U.S. property and casualty industry faces inflationary pressures and the threat of an economic recession, it can take solace in the benefits associated with rising interest rates.

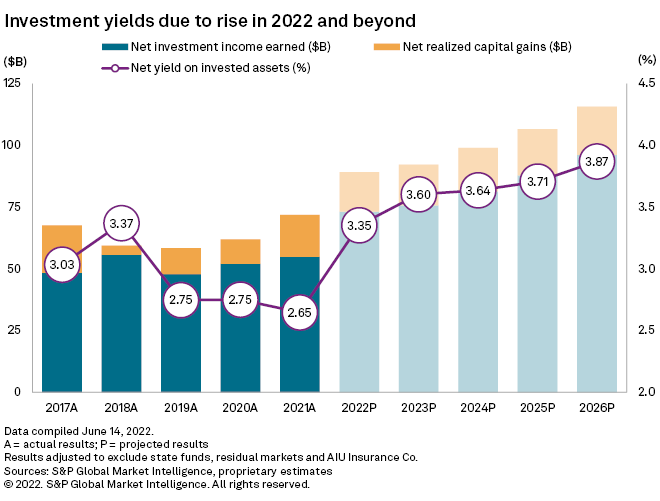

Anemic P&C industry net yields on invested assets likely bottomed out in 2021, suggesting a long-awaited change in a downward trajectory that goes back nearly 20 years. Central bank interest rate policy suggests a prolonged period of tightening, but the industry is poised for a recovery in 2022 that may be exaggerated due to the magnitude of a large, one-off transaction in the first quarter.

Stronger investment results would be beneficial to the industry's pretax returns on capital and surplus as they would help to offset the weaker underwriting results we have projected for 2022 relative to the previous four years.

Low for long

With 66.1% of the P&C industry's unaffiliated investments allocated to bonds, cash, cash equivalents or short-term assets as of the end of 2021, given carriers' general need to focus on high-quality, liquid positions, interest rate trends materially impact overall profitability.

The Federal Reserve has already raised short-term rates by 150 basis points in 2022 and has signaled further rate hikes during the remainder of the year. Intermediate rates have risen considerably through late June as well, with the average yields on the two-year, three-year and five-year Treasurys increasing more than 115 basis points in 2022 from the fourth quarter of 2021.

From 2003 through 2021, trailing-12-month P&C industry net yields on invested assets had declined sequentially by an average of 2.8 basis points in 49 out of 76 periods. The net yield on invested assets for the trailing-12-month period ended Dec. 31, 2021, of 2.64% was 204 basis points below the result for the comparable period ended March 31, 2003.

Returns were so anemic that the National Association of Insurance Commissioners, after the release of 2019 annual statements, lowered its upper and lower thresholds for unusual values in its Insurance Regulatory Information System ratios, which provide a means for state insurance departments to help analyze the financial condition of the carriers they regulate. The new lower and upper bounds of 2.0% and 5.5% each were 100 basis points below the previous markers.

Even with the bar lowered, net yields on invested assets fell short of 2.0% in 2021 for more than two-thirds of the 1,309 combined annual statement filers and standalone entities with some amount of average invested assets. Only 11 produced yields in excess of 5.5%, most notably The Allstate Corp.'s Allstate Insurance Group. The combined group's net investment income included a $1.25 billion extraordinary dividend associated with the sale of the former Allstate Life Insurance Co., now Everlake Life Insurance Co.

While time will be required for insurers to fully turn over low-yielding bond portfolios, insurers appear to be better positioned than at the start of previous tightening cycles to take advantage of increasingly attractive new money yields from a portfolio duration standpoint. Even so, we anticipate the industry's full-year 2022 net yield on invested assets may appear to exaggerate the pace at which reinvestment will occur.

A cursory look at results through the first three months of 2022 suggests that the industry is already well on its way to a result well into the 3% range for the full year. The net yield on invested assets for the quarter of 4.25% stands as the industry's highest result since the last three months of 2014. For the trailing-12-month period ended March 31, the result of 3.09% was the highest in two years.

Each of those increases, however, were attributable to extraordinary result in the first quarter of 2022 by the Columbia Insurance Co. subsidiary of Berkshire Hathaway Inc. Columbia Insurance reported $11.97 billion in net investment income for the period, an amount that exceeded its tally for the previous 10 quarters, combined. The insurer received distributions totaling $10.75 billion in cash and U.S. Treasurys from BH Finance LLC, an affiliate in which it held a joint venture interest valued at $17.92 billion at year-end 2021.

When removing Columbia Insurance's results, the industry's net yield on invested assets would have totaled just 2.31% for the first quarter of 2022 and 2.59% for the trailing 12 months ended March 31, 2022. Both of those values would have ranked as the industry's lowest in 20-plus years.

Given the magnitude of that one-off distribution, we project a 2022 P&C industry net yield on invested assets of 3.35%, an increase of approximately 70 basis points year over year to what would represent the highest such result since 2018. The most rapid year-over-year increase in the industry's net yield on invested assets in the past 20 years occurred in 2005 at 56 basis points.

Market volatility

Rising interest rates led to a massive downward swing in the P&C industry's net unrealized capital gain and loss position, or the aggregate difference between the fair value and statement value of investments, during the first quarter of 2022. More of the same would seem to be in store in light of movements during the second quarter.

The net change in unrealized gains and losses of a negative $21.39 billion ranked fourth-largest in the past 20 years, behind only the first quarter of 2020, the fourth quarter of 2018 and the fourth quarter of 2008. While fortunes changed quickly in subsequent periods in 2020 and 2018, the 2008 result came amid a stretch of seven quarters during which the cumulative net change in unrealized gains and losses was a negative $81.98 billion.

Negative net changes in unrealized gains and losses serve as a drag on policyholders' surplus, but not the statutory income statement. To that end, the P&C industry's surplus declined slightly on a sequential basis in the first quarter of 2022 despite it having posted its largest amount of net income in any quarter on record (thanks in large part to the Columbia Insurance result).

P&C insurers generally hold bond investments to maturity, and comments from the industry in first-quarter 2022 conference calls and regulatory filings suggest no change to that philosophy.

Dismal equity market performance could weigh on investment results, including through net realized capital losses, for some carriers. But while the industry's overall allocation to unaffiliated common stock amounted to 26.9% of unaffiliated investments at year-end 2021, 73.9% of the carrying value of those investments was concentrated within Berkshire and the group led by State Farm Mutual Automobile Insurance Co., according to combined annual statement data.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.